DECENTRALIZED ROBOTICS: LANDSCAPE AND OUTLOOK

Key Takeaways

Decentralized robotics represents a structural evolution in how machines operate, learn, coordinate, and create economic value. The sector now demonstrates:

Real revenue

Live industrial deployments

Scalable AI research and coordination frameworks

Models for democratized investment and ownership

Emerging benchmark for embodied AI

This is no longer a speculative concept; it provides product market fit with real world impact.

The sector’s current aggregate valuation remains disconnected from its long-term addressable market, presenting an asymmetric entry window for early positioning.

Executive Summary

70% of the world’s GDP is still tied to physical locations and labor.

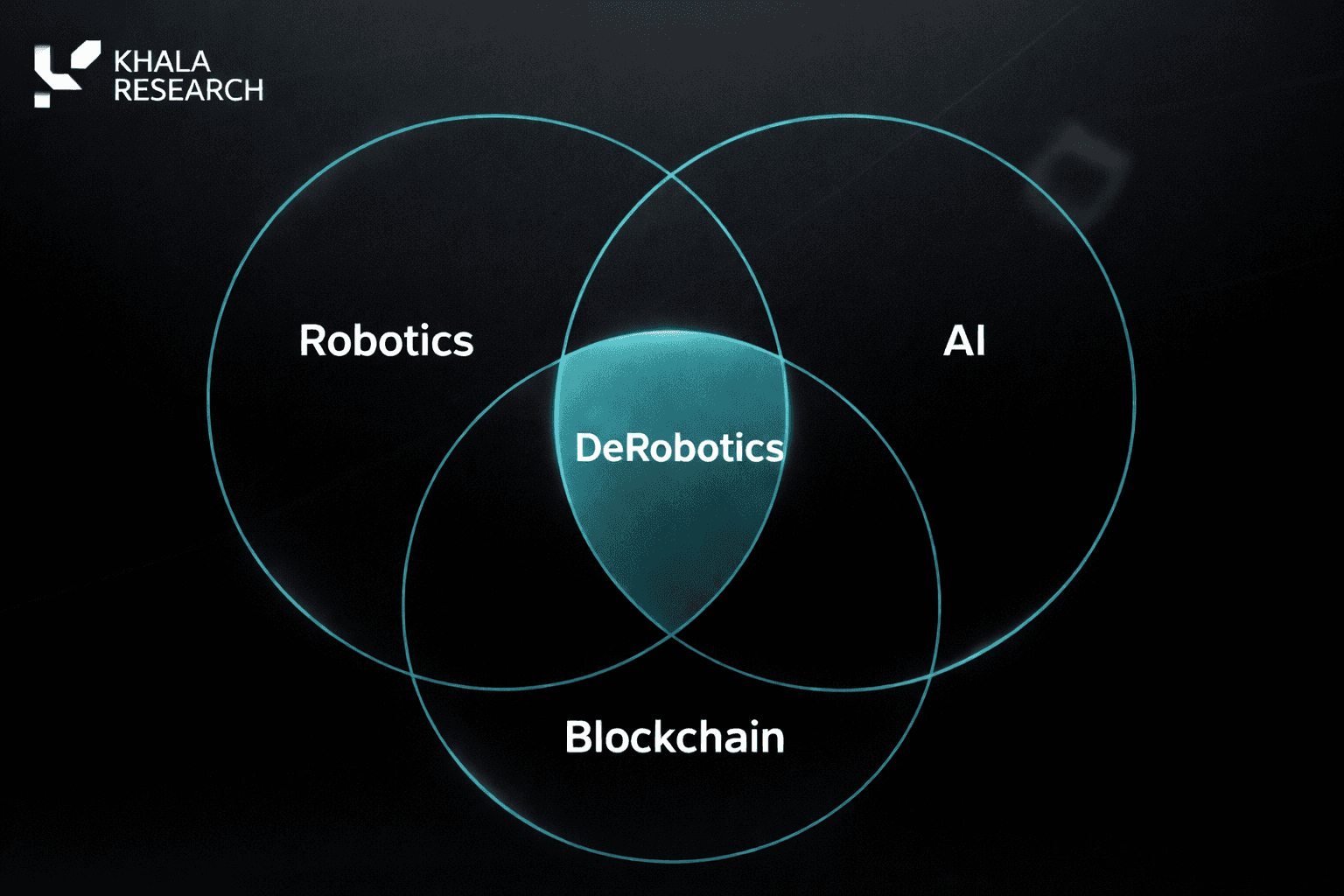

DeRobotics is the intersection of Artificial Intelligence, robotics, blockchain, and agentic payment protocols (Coinbase’s x402, A2A etc.), represents one of the most important technology themes for 2026.

As AI models become more capable, their physical counterparts gain the ability to perceive, navigate, and act autonomously in the real world. Combined with permissionless payments and shared data networks, robots can increasingly operate, transact, and coordinate without centralized control.

Three converging trends drive this transition:

Embodied AI advances: Vision‑Language‑Action (VLA) models, multimodal inference, and simulation accelerate real-world task completion.

Decentralized infrastructure: Machine identity, micropayments, spatial mapping, and geospatial networks allow robots to participate in the global economy.

Retail accessibility: Physical robots (visible, tactile, and demonstrably useful) offer a clearer onboarding path for the public than intangible crypto products.

Mass deployment of physical machines, in the form of embodied AI will be a theme of the next decade with tangible developments anticipated as early as next year.

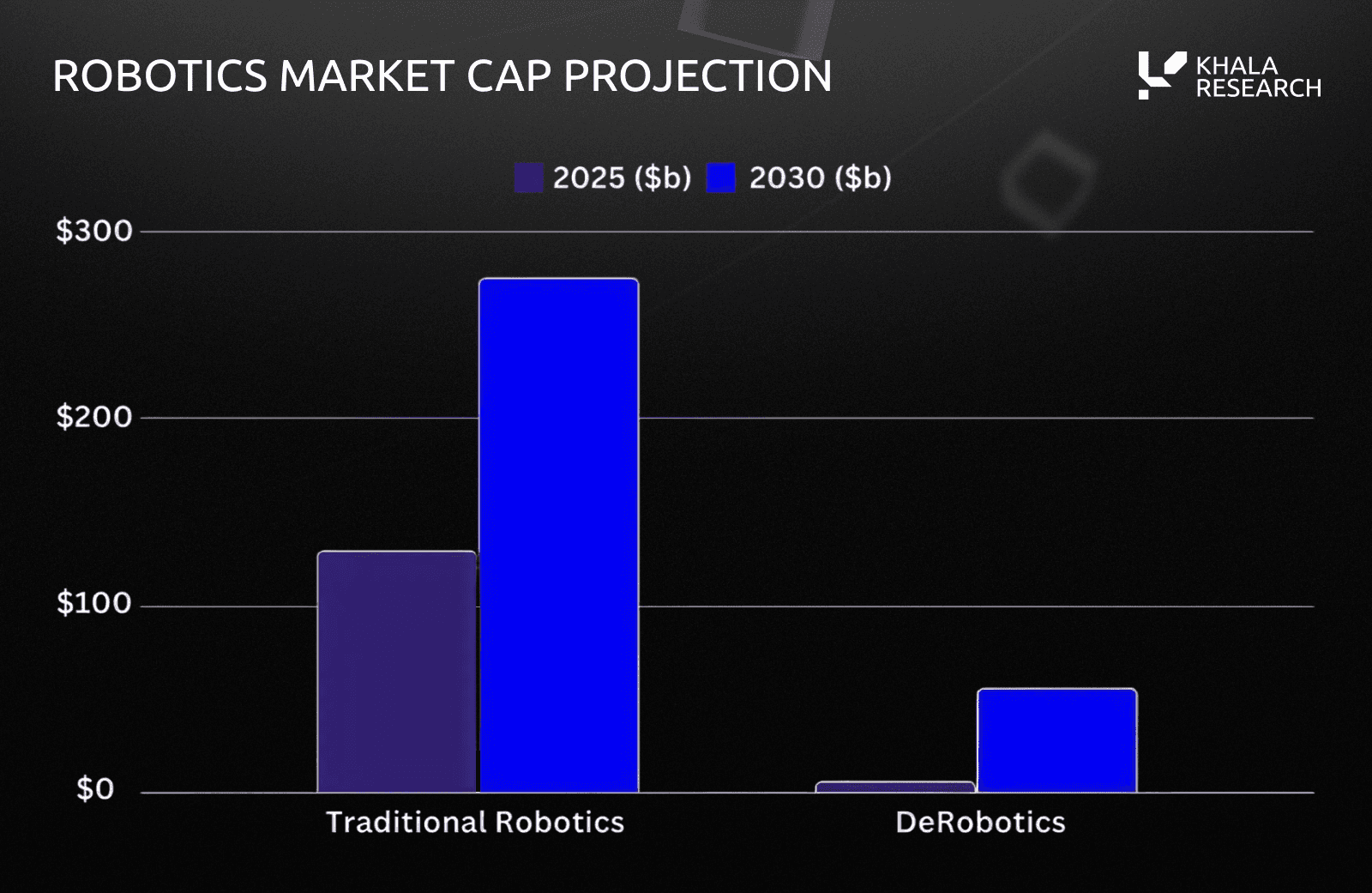

Global Robotics is projected to grow from ~$128B in 2025 to ~$275B by 2030:

DeRobotics is arguably in its infancy compared to traditional robotics, suggesting a greater level of upside to compensate for the additional early stage risk.

It’s possible that DeRobotics will merge into the broader “multi-trillion-dollar" traditional robotics market as blockchain networks are more deeply integrated into 'Big tech' systems. If we use "DeFi" as an example, it’s clear that traditional finance is adopting crypto payment rails, and as such it’s likely DeFi + Traditional Finance (TradFi) will simply be known as 'Finance' in the medium term future.

So while this report focuses on the emerging decentralized networks, it’s important to view this in the context of robotics more broadly.

This report outlines the DeRobotics sector’s architecture, evaluates leading networks, and provides context for the economic and technical forces shaping this emerging market.

1. Market Context and Growth Drivers

Decentralized robotics networks aim to disintermediate centralized control and ownership of robots with token-incentivized, globally distributed systems, enabling:

Autonomous machine-to-machine, and machine-to-human transactions (x402)

Fractional ownership of physical robots and industrial hardware (XMAQUINA)

Shared robotic intelligence through federated AI and decentralized model training (TAO subnets, Bitrobot)

Open, collaborative infrastructure for mapping, positioning, and control (GEODNET, Auki)

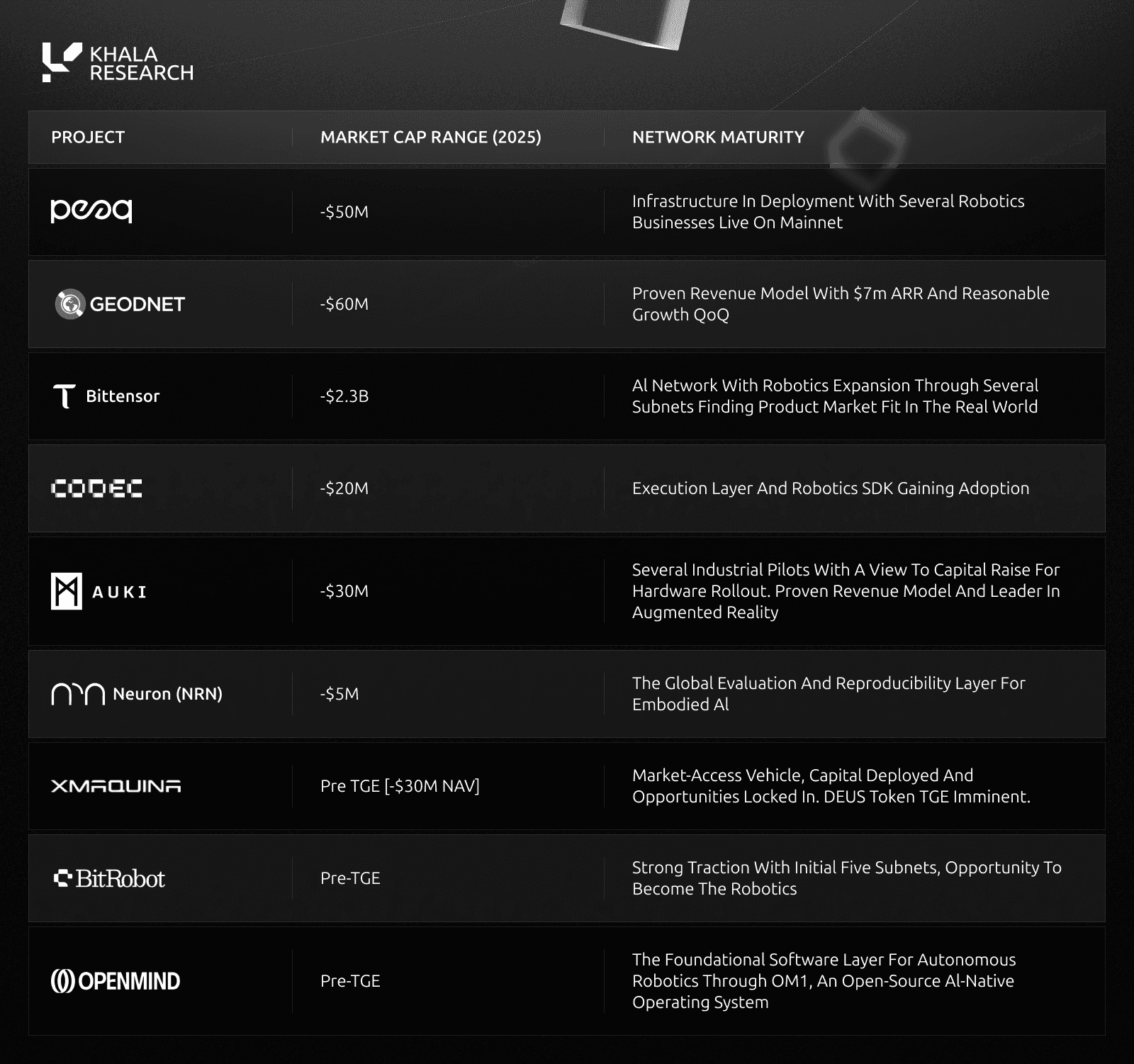

Several companies are emerging as leaders within this crypto segment:

BitRobot (including Virtuals' SeeSaw)

13 Bittensor (TAO) Subnets

AI, and in turn Physical AI, has evolved at an exponential pace with embodied AI anticipated to move as fluidly as humans in the not-too-distant-future.

A widely circulated projection from industry leaders suggests the long‑term production of billions of robots, creating a multi‑trillion‑dollar, possibly quadrillion-dollar, sector. While the exact figures are speculative, the direction of travel is unambiguous: robotics will become as economically significant as smartphones or cloud computing.

1.1 - Robotics Growth Dynamics

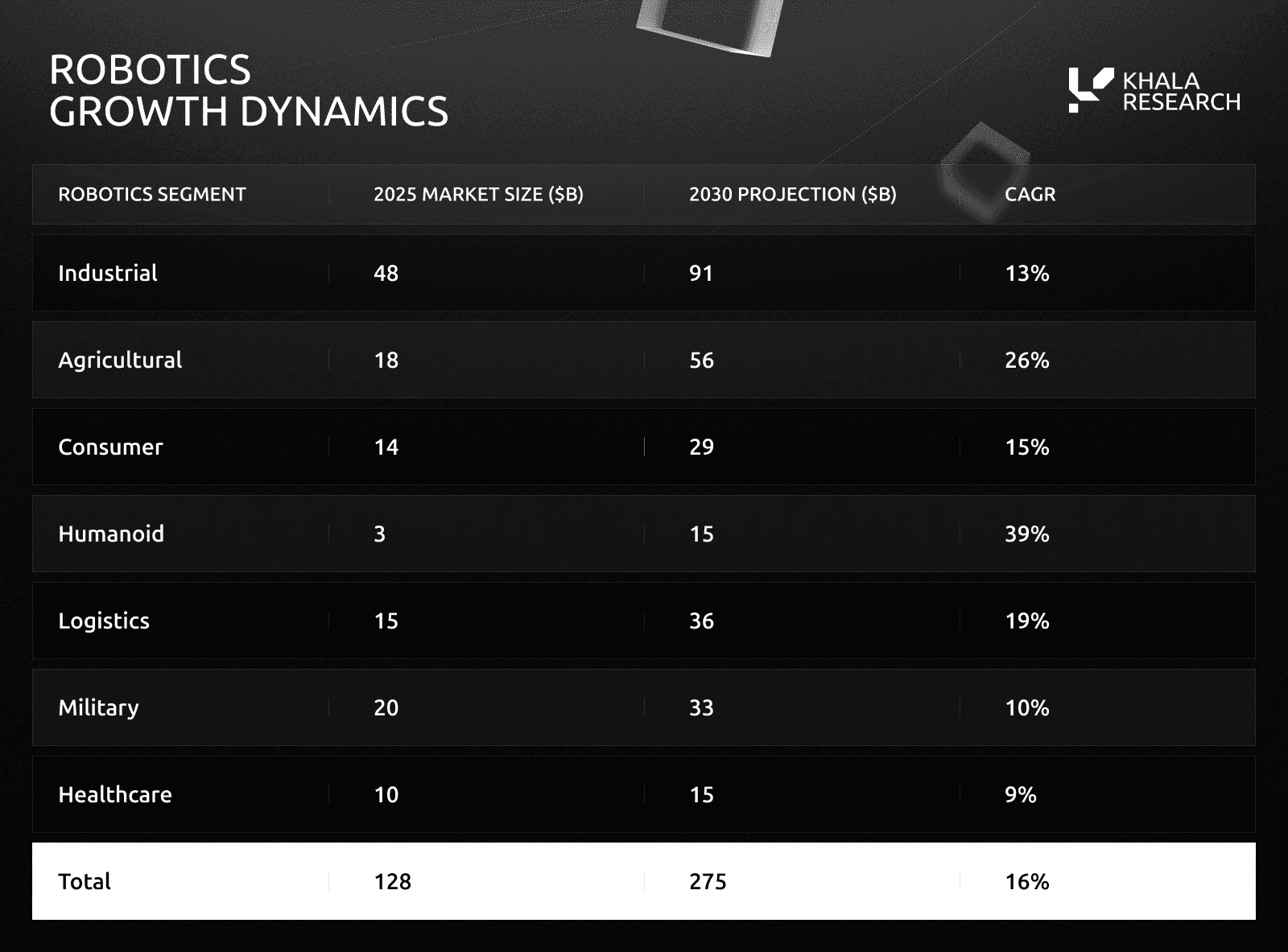

Sub-segments are expected to expand rapidly:

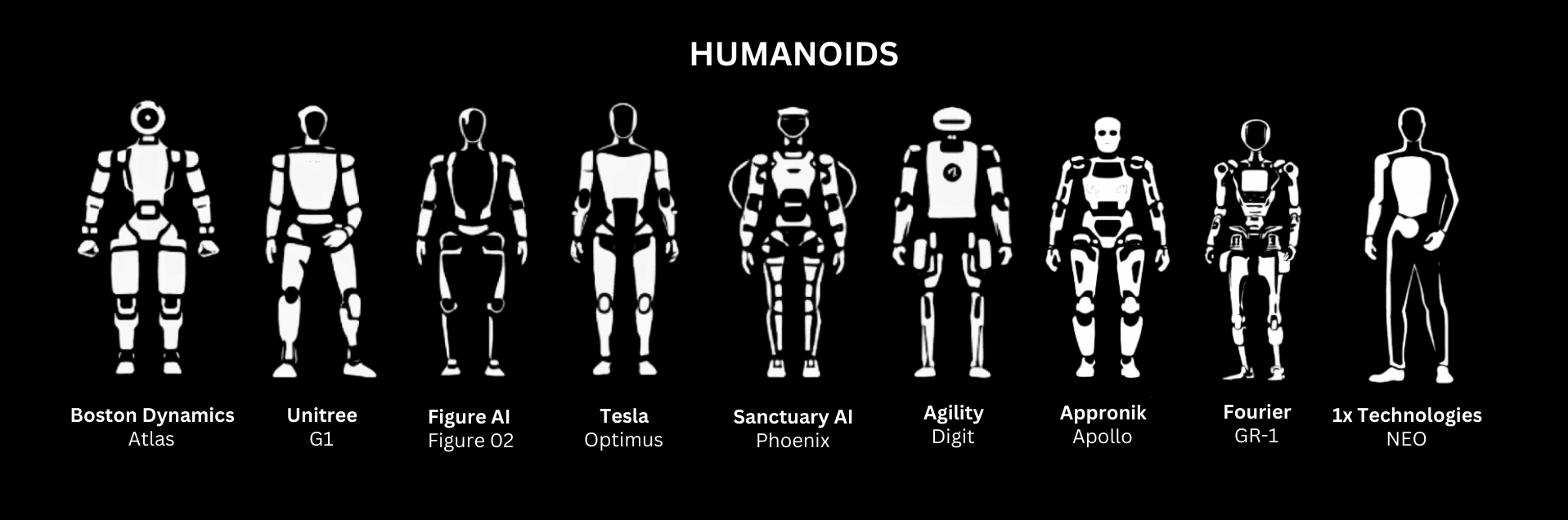

The humanoid category has received significant attention recently due to progress in capabilities and commercial feasibility with thousands of units anticipated to be sold to retail in 2026:

Goldman Sachs predicts the Humanoid category alone could hit $38B within the next 10 years.

All of these robots require shared intelligence, simulation, coordination, and environment mapping systems; areas where decentralized approaches may be structurally advantageous.

The macro robotics sector is influenced by several structural forces:

Driver | Impact |

|---|---|

Labor shortages and rising wages | Increases demand for automation across manufacturing, logistics and agriculture |

Declining hardware and sensor costs | Lowers barriers for robot deployment and ownership |

Reshoring and sovereign industrial policy | Encourages domestic automation infrastructure |

Advancements in large-scale AI models | Enables autonomous decision-making and embodied intelligence |

Several national policies and incentives are being rolled out to encourage domestic production in the United States:

NVIDIA and AMD entered a revenue-sharing agreement to pay the U.S. government 15% of their revenues from specific chip sales to China (H20 and MI308)

Intel received an $8.9 billion investment from the U.S. government through the issuance of 433 million new shares, giving Washington a 10% equity stake in the company.

1.2 - Why Decentralization Matters in Robotics

Traditional robotics architectures rely on centralized controllers and proprietary cloud systems. This model faces several structural limitations:

Limitation | Decentralized Network Advantage |

|---|---|

Single point of failure | Distributed control → Fault tolerance |

Bottlenecks in scaling robot fleets | Horizontal scalability via peer coordination |

Vendor lock-in and closed data ecosystems | Open, composable systems |

High capital requirements for ownership | Fractional / tokenized ownership models |

Limited incentives to contribute data | Tokenized contribution economy |

Decentralization is particularly valuable in dynamic environments like drone swarms, warehouse logistics, agricultural automation, and humanoid assistants, where real-time local decision-making and resilience are critical.

Pair this with local tooling and robotics training environments, tailored to your own personal home, or factory, and you have a distributed robotics evolution. The large scale robotics manufacturers are unlikely to have the bandwidth to tailor their Software Developer Kits (SDKs) sufficiently to make a meaningful difference in your own personal physical robot.

This opens up an opportunity for DeRobotics to plug the gap with a machine agnostic set of software tools to monetize.

1.3 - Data Shortfalls

The amount of data that AI uses varies dramatically depending on whether you are referring to the training of an AI model or its ongoing operation (inference), as well as the specific application.

One of the leading arguments for the usefulness of Decentralized AI is its data; There isn’t enough high quality data specifically for Robotics.

There’s a plethora of other data types that robots need to operate in the real world:

Data Type | What it Represents | Why it Matters (for AI/Robotics) |

|---|---|---|

Numerical Data | Measured values (speed, weight, temperature) | Used for control, physics, sensing and precise decision-making |

Categorical Data | Labels and groupings (object type, color, location) | Helps systems classify and understand discrete states |

Text Data | Written language | Enables reasoning, instructions, translation, chat and search |

Image & Video Data | Visual information from cameras | Trains perception: Object recognition, scene understanding and navigation |

Audio Data | Sound and speech | Enables voice commands, conversation, environmental awareness |

Time-Series Data | Signals evolving over time | Critical for real-time response, prediction and adaptive control |

Image and video data is lacking, and certainly where decentralized AI protocols can contribute.

Vader AI has rolled out an initiative that distributes glasses to contributors who collect video data on completing routine tasks.

This enhances the contextual data to train robots on tasks that humans do instinctively, but embodied AI finds challenging.

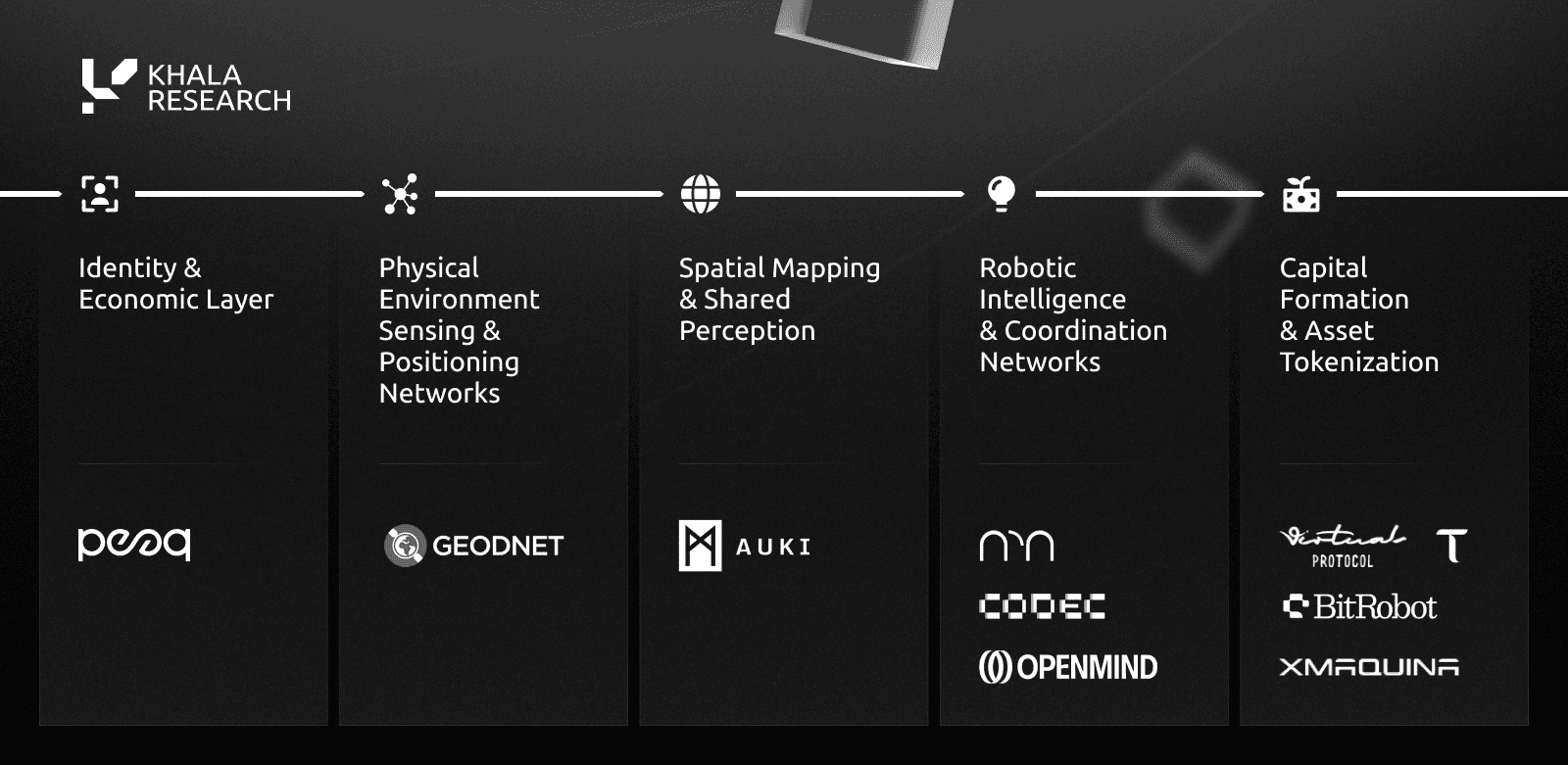

2. Sector Framework: Layers of the DeRobotics Stack

The emerging sector stratifies into several layers:

Each layer solves a distinct technical bottleneck and creates interoperability benefits when integrated.

3. The Current ‘DeRobotics’ Landscape

The current landscape is nascent, some are only just demonstrating product market fit with revenue. Here is a rundown of the diverse range of protocols showing promise as we enter 2026:

3.1 - $PEAQ

Layer 1 for the Machine Economy

peaq serves as the economic system and base coordination layer for the machine economy, similar to how Solana/Ethereum serve DeFi, but as blockchain optimized for machines, robots and autonomous agents, enabling universal standards for identity, ownership, time, access control, and payments for devices and robots on the one side, and a purposely designed token economy that enables micro economies to emerge on top of it through its unique economic model and pool structure on the other.

The protocol, being developed since 2021, has onboarded more than six million (human and machine) users and 180 million transactions since their 'Token Generation Event' (TGE) last year. With the roll-out of the peaq ‘robotics SDK’, any ROS2 compatible machine can now be onboarded to the machine economy, transact and trade with humans and other machines on peaq, and leverage its universal standards.

A notable deployment this month was a tokenized Robo-Farm in Hong Kong, which boasts:

80% automation across hydroponic tasks

ERC-721 “Share” minting model with estimated ~18% annualized yield

Demonstrates real revenue and operational utility, not just proof-of-concept

Making every consumer of salad grown by the farm a direct participant in the decentralized Machine Economy

Introducing a new asset type with $150k TVL (Machine RWA)

Bringing web2 liquidity (salad purchases from average Hong Kong citizens) on the peaq chain

Soon, the farm itself will use its proceeds to invest and participate in other Machine Economies on the network

The opportunity sold out within 24 hours on DualMint, a machine tokenization platform.

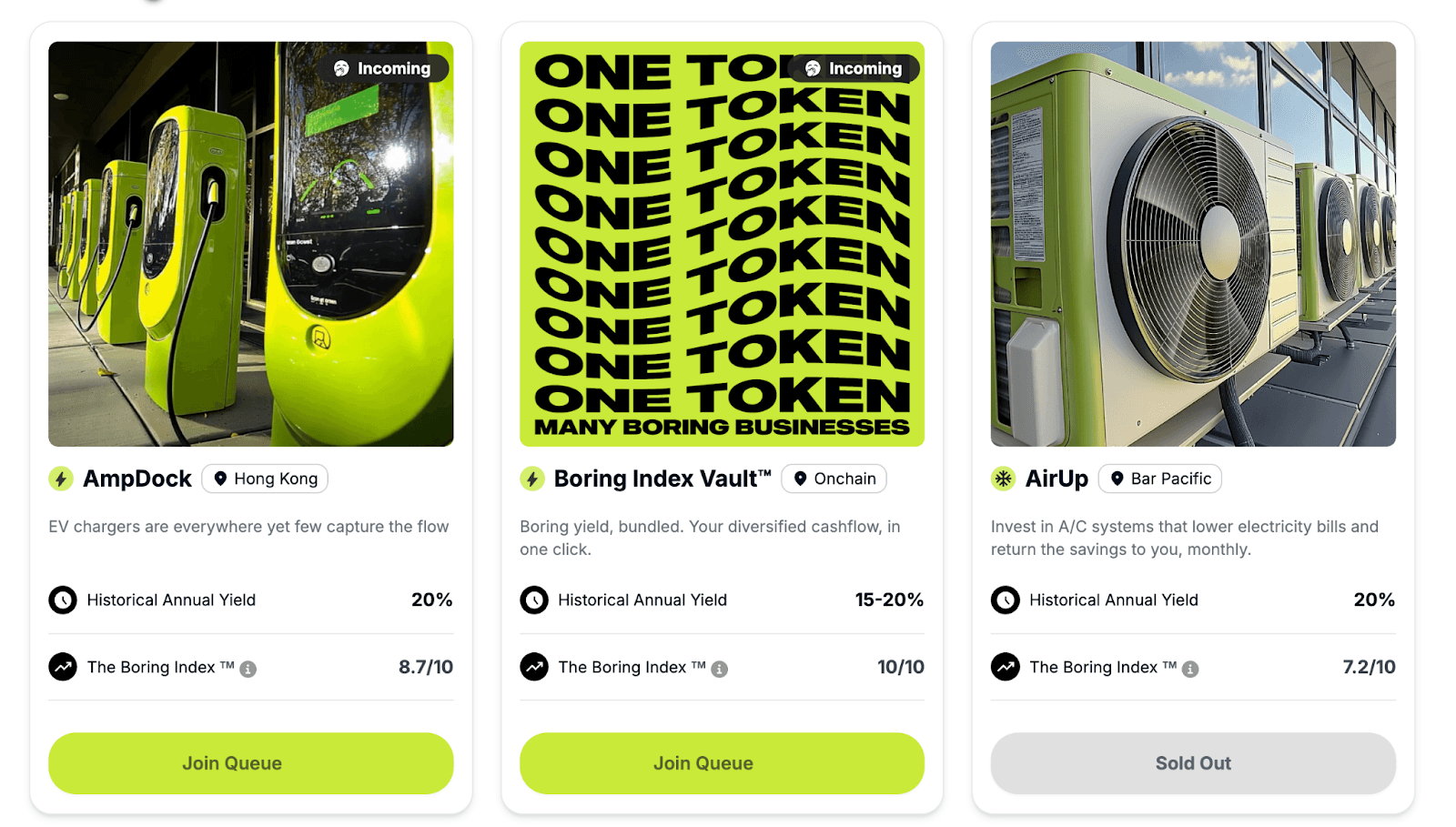

Other opportunities are available to register on the marketplace:

The PEAQ Token:

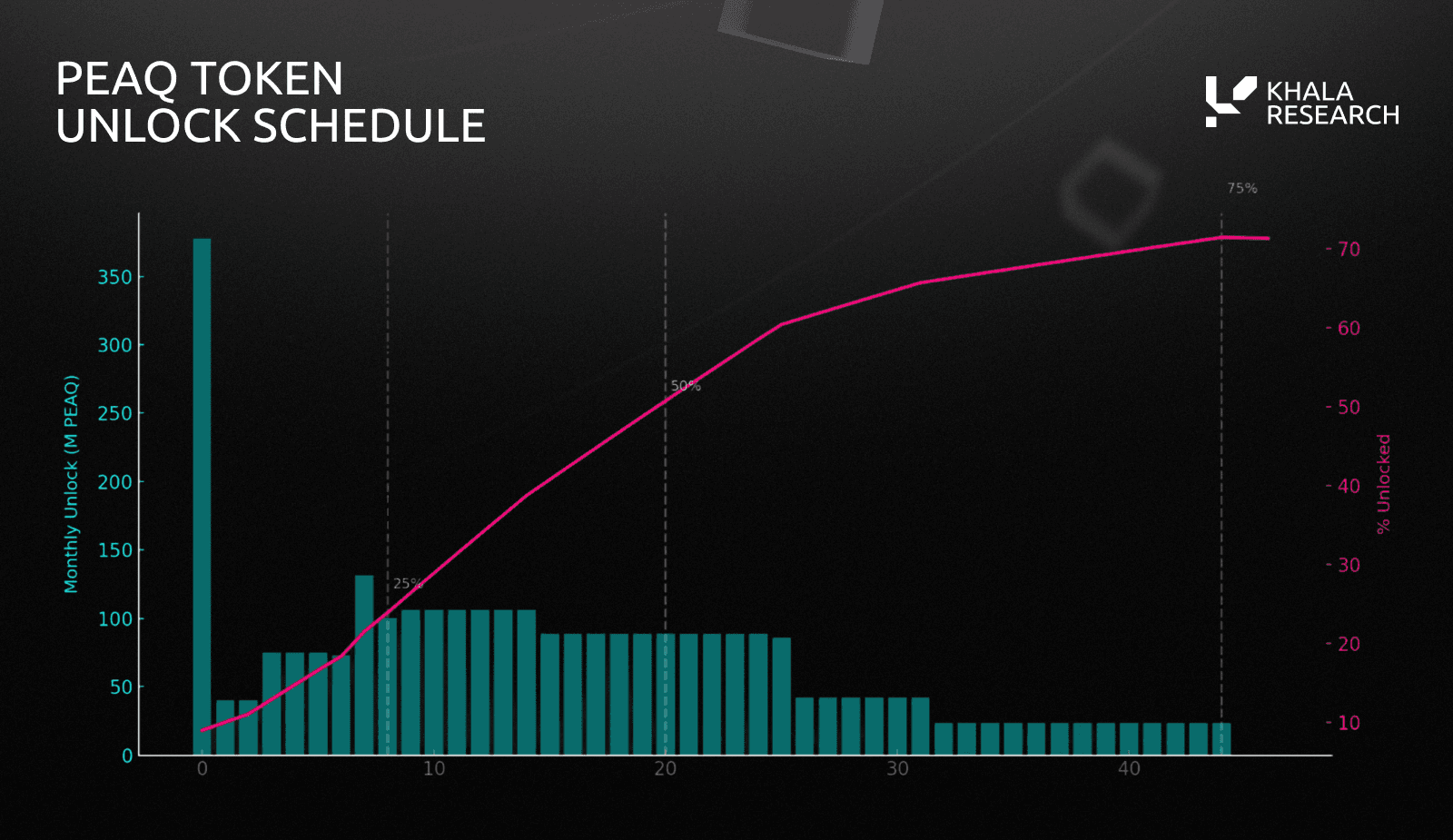

The PEAQ token launched alongside Mainnet on November 12th, 2024. There were a total of 4.2B Genesis tokens at launch, but when factoring in annual inflation of 3.5% ( Net increase of 147M for the first year) with 10.00% annual disinflation until reaching 1.00%. Then five years at 1.0%, after which supply is capped.

Combining this with an increase in activity and commitment to token alignment, then we could see reasonable price performance provided further partnerships are secured and fundamentals are aligned with tokenholder interest through optimal buyback (or similar) models.

Network native pools that are inherent in the peaq economics (Machine onboarding, Machine Incentive Pools among others) will soon be activated to automate a better regulation of supply and demand of the PEAQ token in the network.

Partnerships like the recent Dubai’s VARA framework for regulating onchain robotics and tokenized machines in Dubai, put peaq in a good position for deeper integration within the global emerging technology market, as such a standard is currently absent.

The “Economic Layer for Machines” is a universal concept that becomes easy to grasp.

“peaq is designed to capture a new type of users and a new class of assets to its network - robots, machines, and sensors. The runtime-native functionalities are the backbone for Machines to participate in this economy and create value outside of their closed systems. With the exponential rise of small and medium scale robotics manufacturers globally, and the fragmentation of smart city infrastructure, we are well-positioned to unlock value flows through our network that will significantly increase economic output in the Machine Economy” - Till Wendler, Co-Founder peaq

3.2 - $GEOD

Decentralized GNSS / RTK Positioning

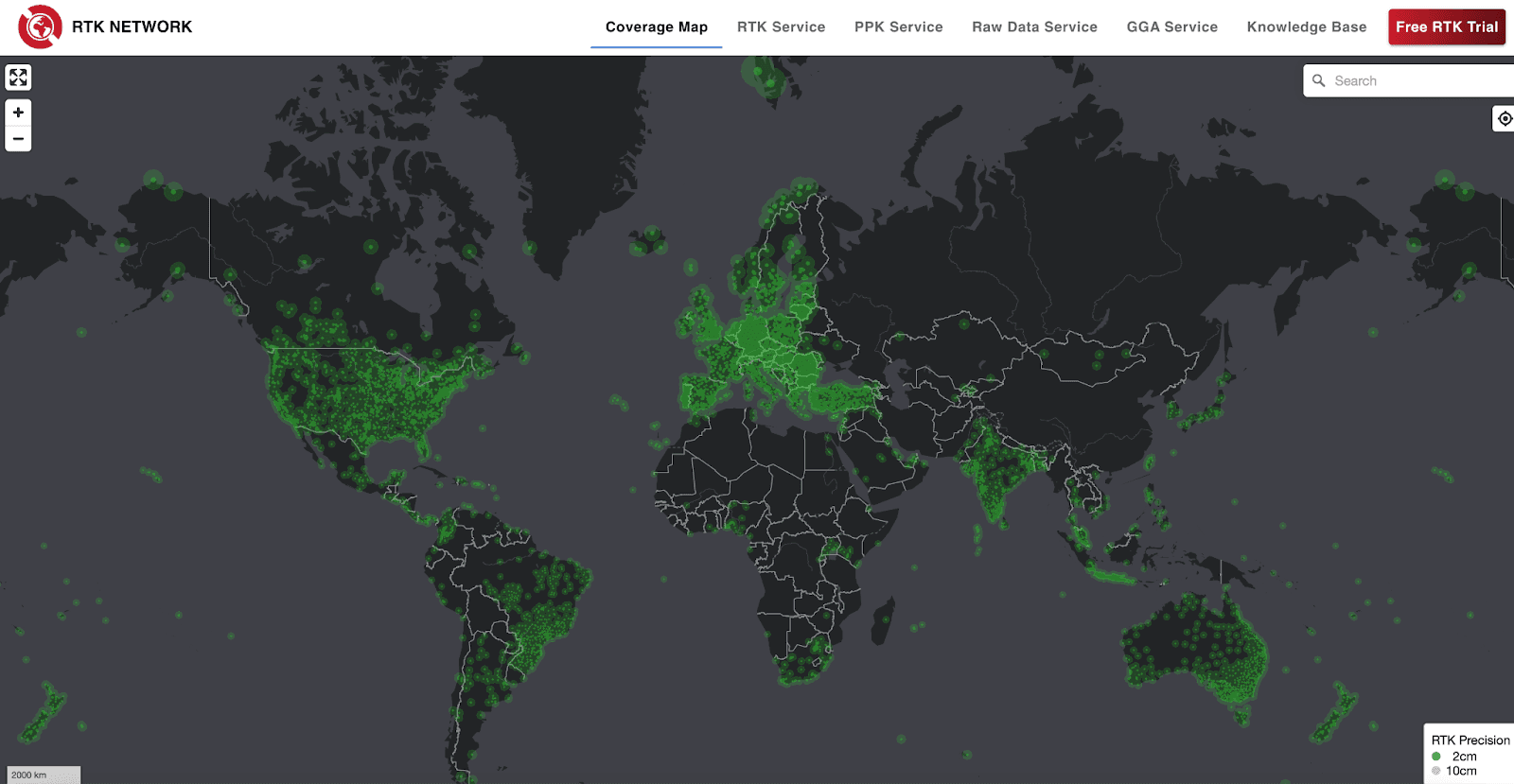

Global Earth Observation Decentralized Network (“GEODNET”) provides centimeter-level accuracy precision positioning.

This is known as real-time kinematic (“RTK”) data through a network of decentralized reference stations as seen across this coverage map:

This data can be used for a variety of use cases, including:

Autonomous drones

Agricultural machinery

Mobile robotics

Mapping and surveying

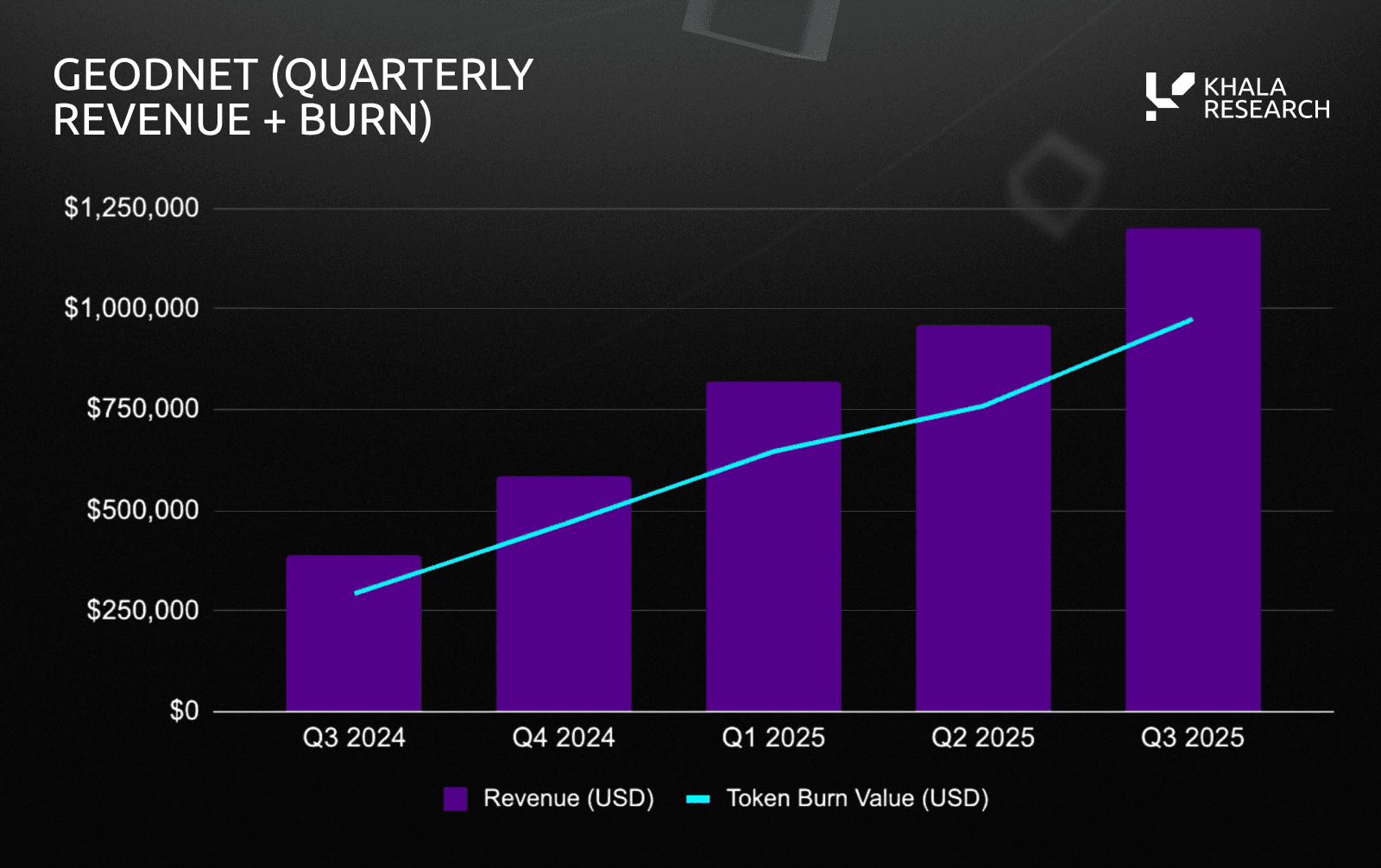

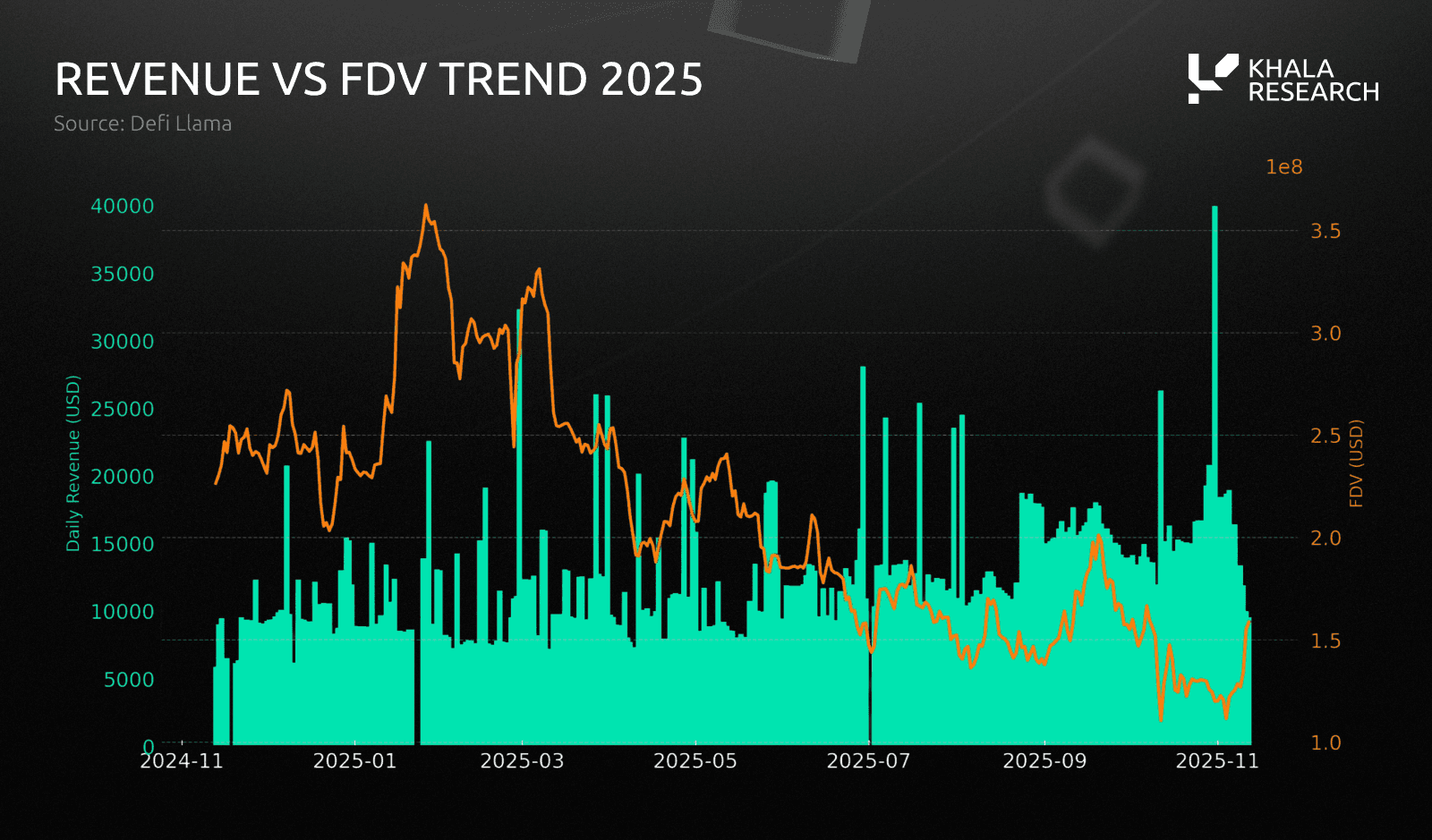

Typically we would expect a positive correlation between valuation and fee revenue, particularly given the commitment to align tokenholder interests with the fundamentals of the business via an 80% buyback model.

GEOD has seen a steady increase to >$7M ARR with compounding quarterly growth:

There’s been a short term negative correlation between valuation and revenue, driven largely by the adverse macro movement in the broader crypto market following the cascading liquidation events on October 10th:

We anticipate this to shift as robotics becomes more entrenched in society and enters mass production to completely revamp the existing human workforce, creating a strong appetite for geospatial positioning data.

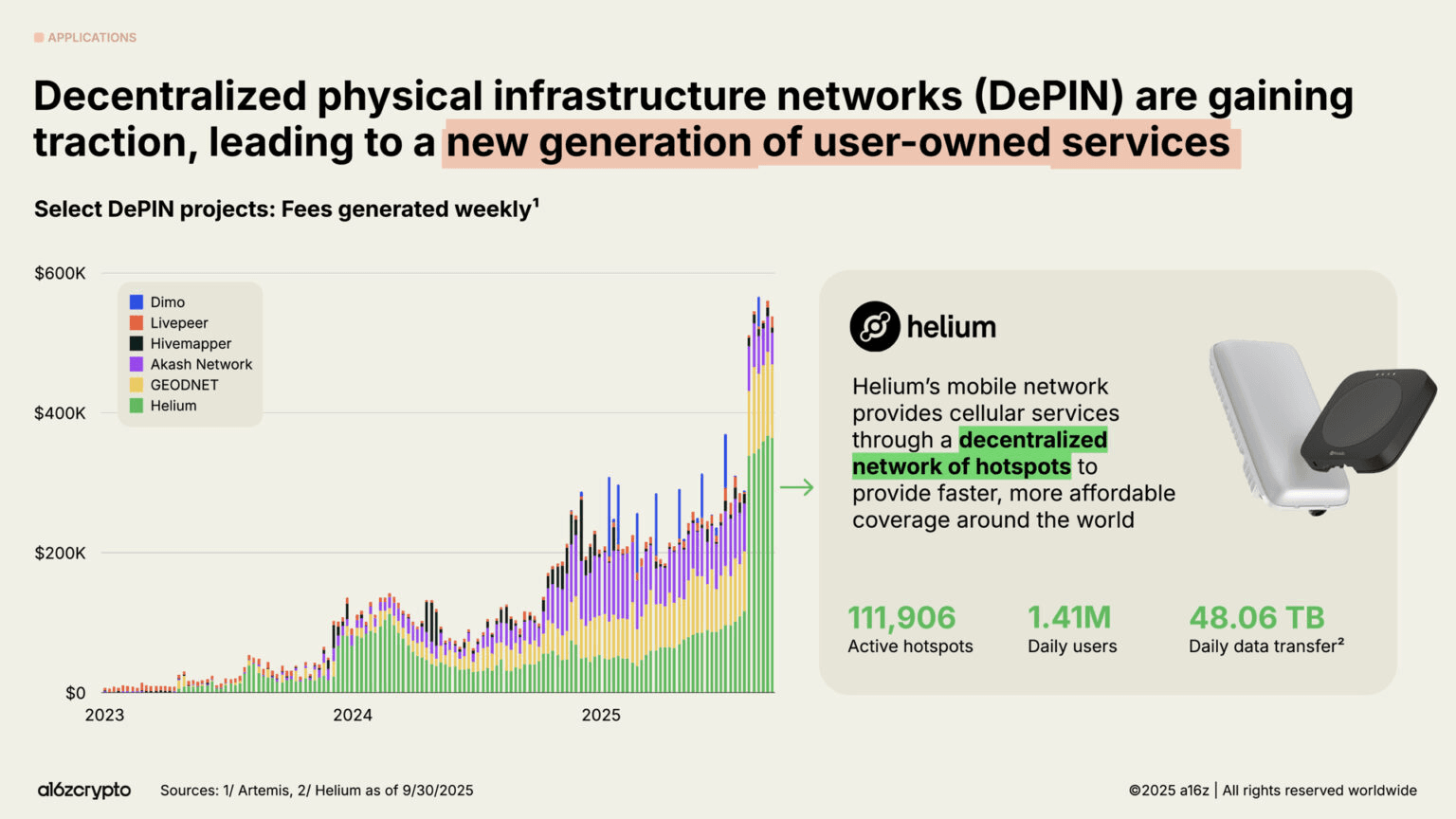

According to a report by A16z, Decentralized Physical Infrastructure Networks (“DePIN”) is set to grow to a multi trillion dollar industry in its own right, of which GEODNET is highlighted in second spot behind Helium:

“The World Economic Forum projects the DePIN category will grow to $3.5 trillion by 2028.”

Fundamentally GEODNET has strong global network coverage; 20,000+ satellite miner stations across 150+ countries.

GEODNET's product traction caught the attention of Multicoin Capital, who purchased $8mm of the token in February 2025. Speaking on the Supercycle Podcast, Multicoin General Partner Shayon Sengupta shares the story of first meeting Mike:

GEODNET is one of the few proven revenue-generating DePIN projects with real enterprise customers. Its resource network growth directly increases service reliability, forming a strong flywheel for tokenholders, assuming its buyback model and demand for its data continues.

“$GEOD isn’t a hype machine, it’s a utility engine. Every new drone, robot, tractor, and rover tapping into the GEODNET RTK network creates real demand, real revenue, and real burn.” - Mike Horton, Project Creator, GEODNET

For more information, the Khala Research team suggest readers to listen to CEO Mike's talk at the 2025 Multicoin Summit:

3.3 - BitRobot [Pre-TGE]

The World’s Open Robotics Lab

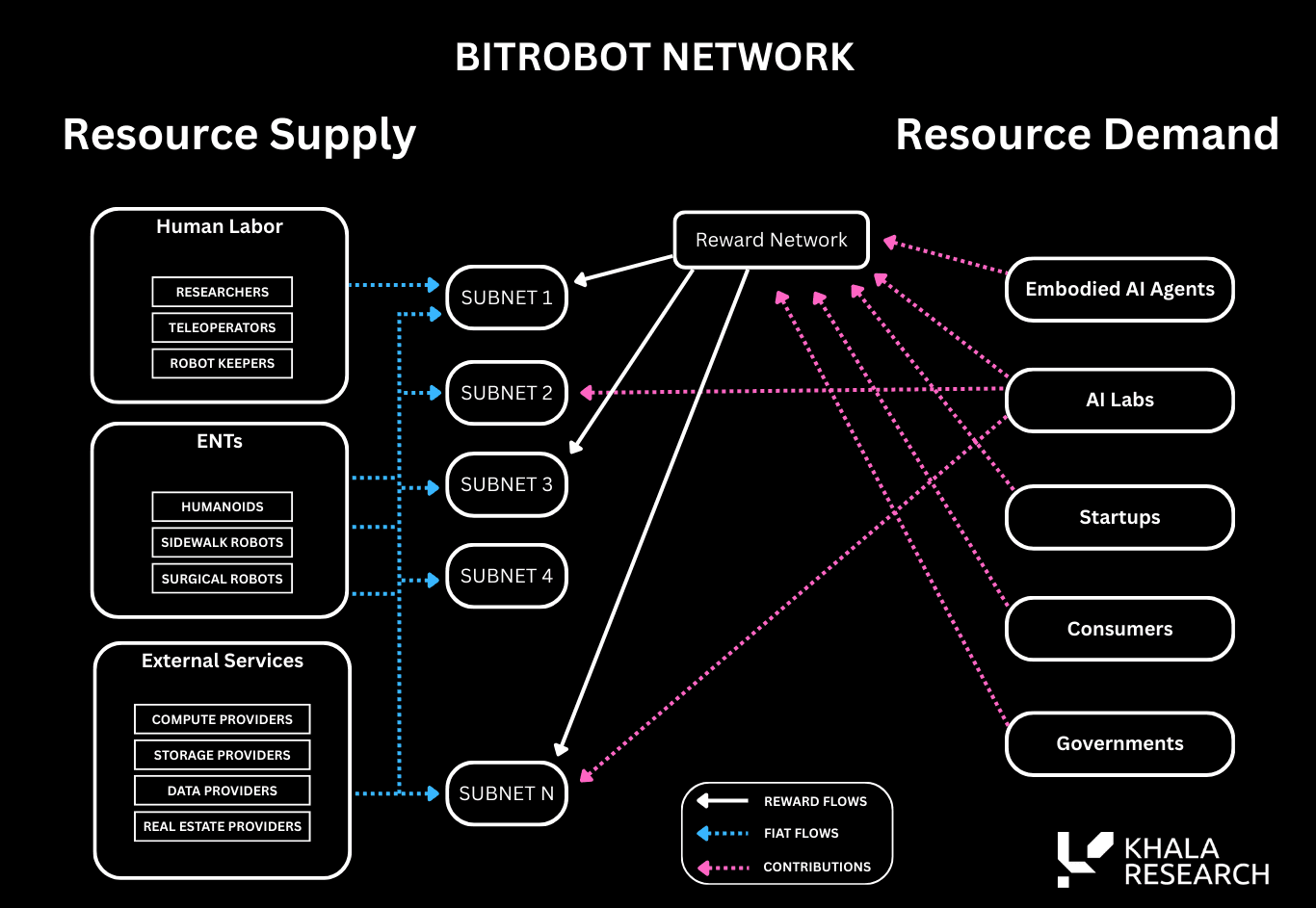

BitRobot is a modular network of robotic subnets, each generating valuable resources, to accelerate Embodied AI and robotics innovation.

It was co-developed by Michael Cho (FrodoBots Lab cofounder), Jonathan Victor (former Filecoin Ecosystem Lead), and Juan Benet (creator of Filecoin and IPFS). The project is currently tokenless, but intends to launch a network token to incentivize resource co-ordination for progressing robotics training using a network of subnets. Here's a video on Frodobot's Earthrover:

Subnet Structure:

A BitRobot Subnet is a focused cluster of contributors and resources working together to create value for the BitRobot Network.

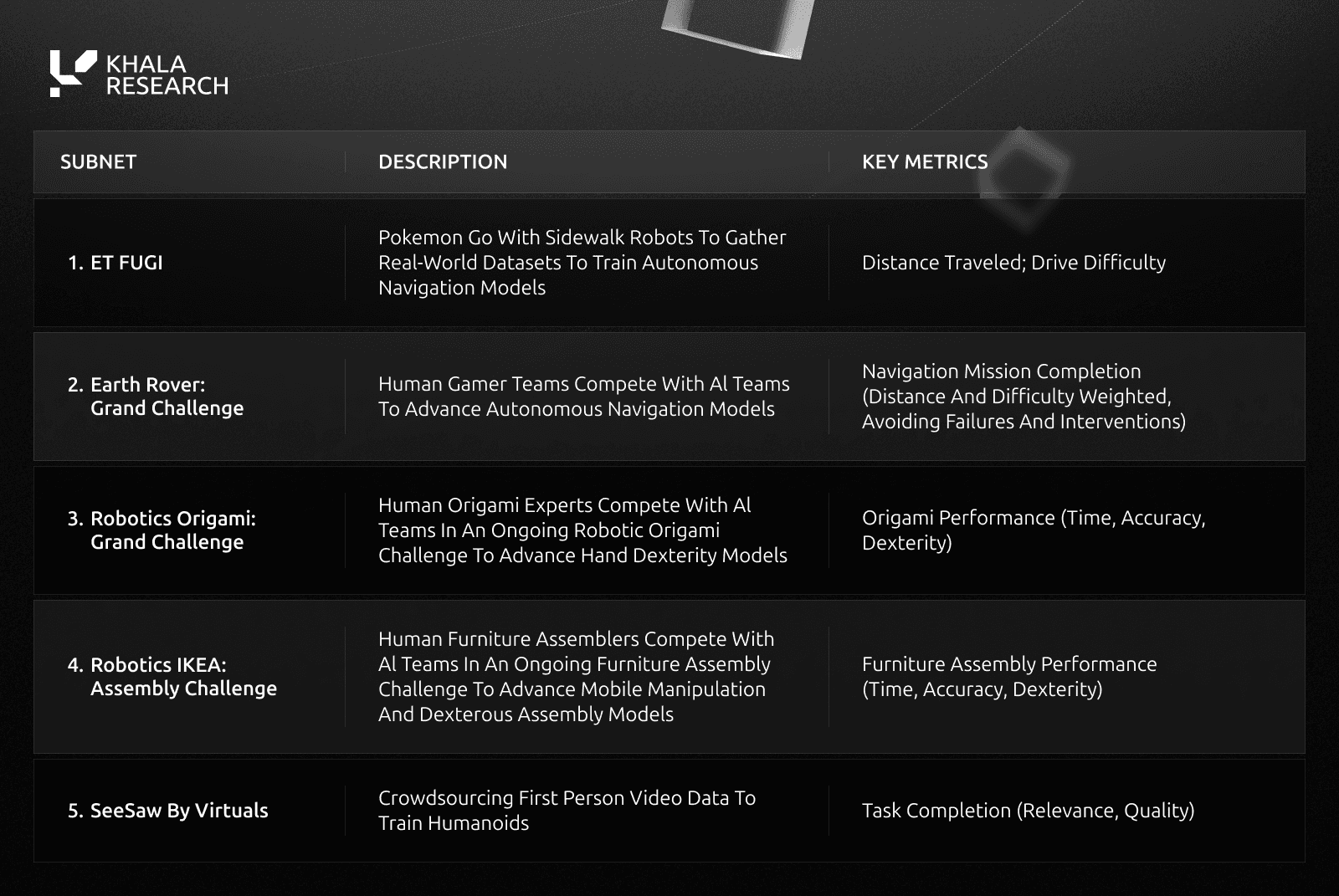

Subnets vary in what they do: some focus on hardware procurement, others build new datasets (teleoperation, video, and simulation) or train new models. So far, five subnets have been publicly announced out of 14 live or in development. In addition, over 25 additional teams are in the pipeline. The five publicly announced subnets are:

Virtual's subnet 5 ("SeeSaw") has been subtly integrated into its Agent Commerce Protocol ("ACP"):

This year, we’ve been quietly placing serious bets on robotics as a core pillar of Virtuals Protocol, from SeeSaw surpassing half a million recorded tasks to early-stage ACP integrations with robots and capital formation rails for embodied agents.

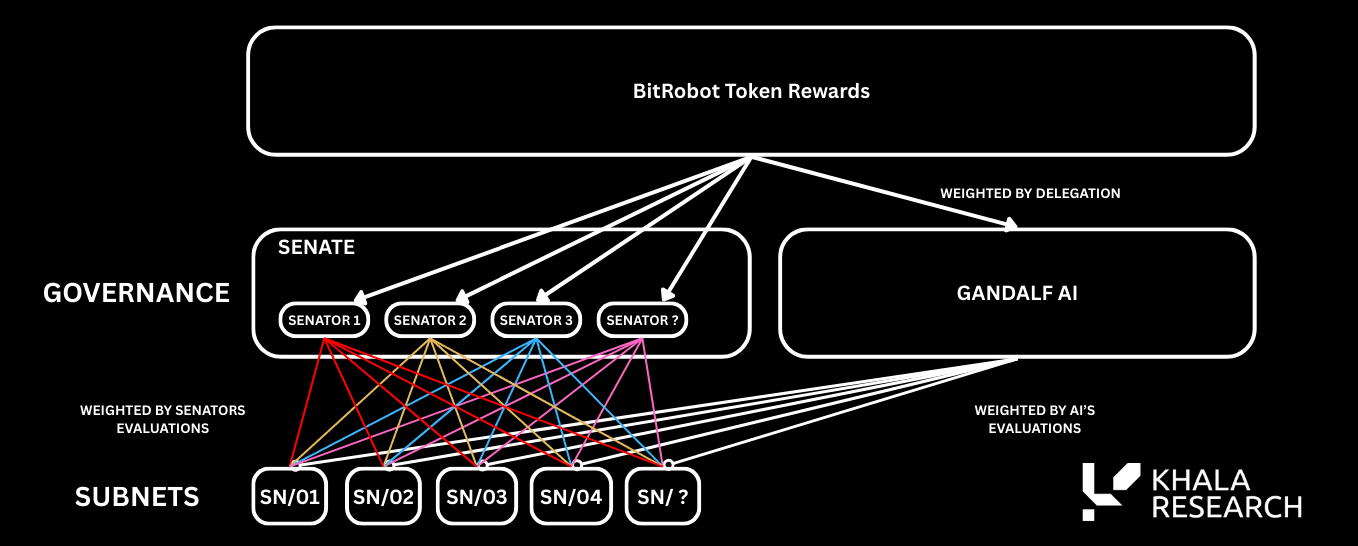

The incentive structure for subnet emissions will be established based on a governance framework that includes the Senate and an AI entity “Gandalf AI”:

The BitRobot Senate is composed of nominated representatives of the Embodied AI research communities, with the aim of resources flowing towards the subnets creating the highest value.

What’s BitRobot Aiming to Solve?

Unlike language and vision AI, robotics is still held back by closed ecosystems, fragmented tools, and limited real-world testing; leaving most progress locked inside a few large labs. Here's CEO Michael on our Supercycle Podcast, discussing the founding story for Bitrobot:

BitRobot addresses this by incentivising global contributors to collect data (video, teleoperation, and simulation), train models, and test policies; forming the foundation for general-purpose physical AI.

Built as a Solana protocol, each subnet operates as an open research mission where people, robots, and compute coordinate to advance embodied AI.

To accelerate progress, the BitRobot Foundation has launched a $5M Grand Challenges Fund, initially supporting the Earth Rovers (navigation), Robotic Origami (dexterity), and Robotic IKEA Assembly (manipulation) subnets.

White the protocol is in its early stages, it’s clear they’ve got a wealth of expertise and are incentivizing network contributors to solve real world robotics problems with established partners - incentivizing global contributors to collect a breadth of multi-modal data will be the solution to creating a foundation for general purpose AI, including Robotics.

3.4 - $CODEC

AI Execution and Inference Marketplace for Robots

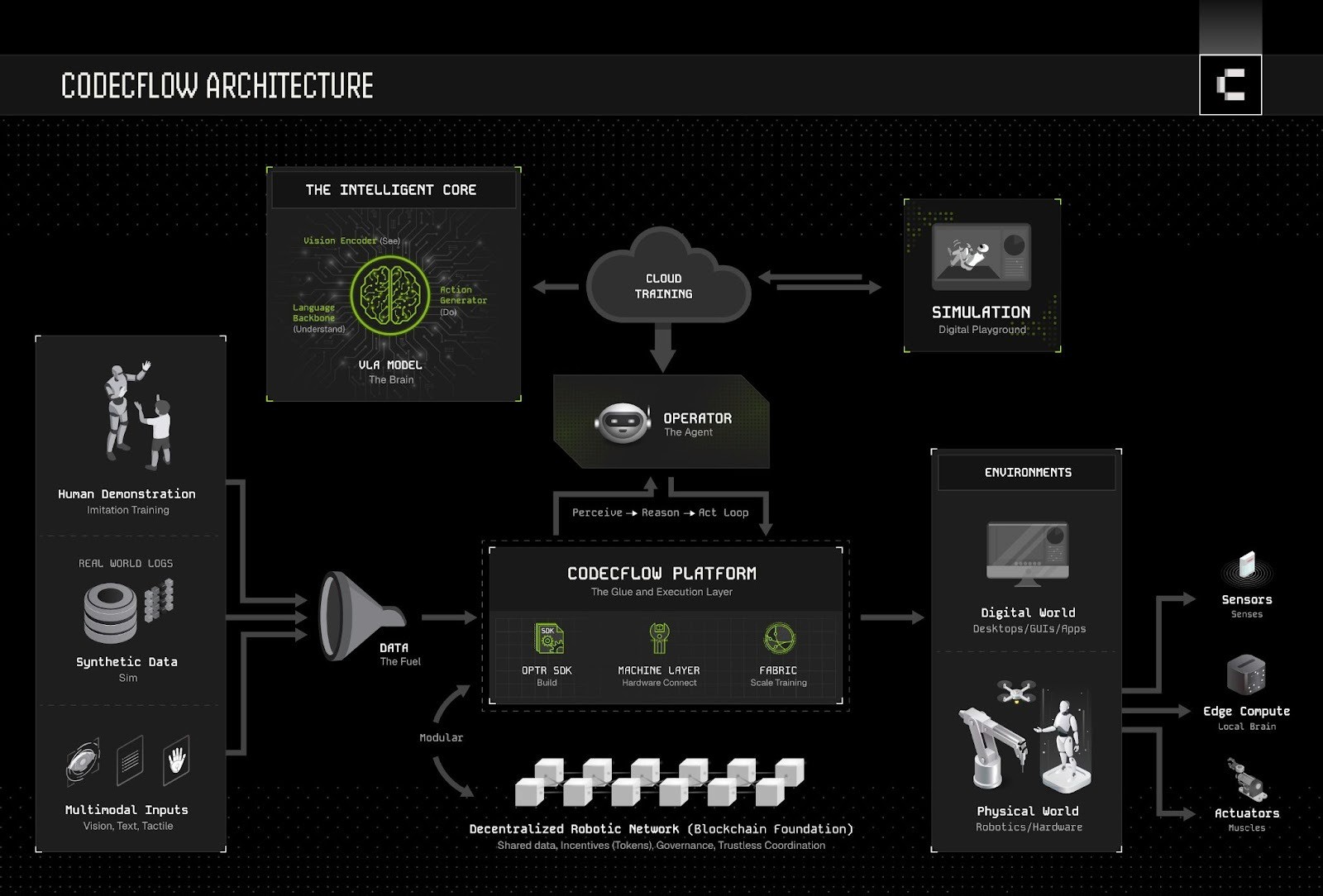

CodecFlow ("CODEC") acts as the operational layer for embodied AI, bridging:

The CODEC SDK provides robots with access to vision-language-action models via decentralized compute nodes. To date Codec has served 2.8M+ inference calls, across 450+ models and 1,200+ compute suppliers.

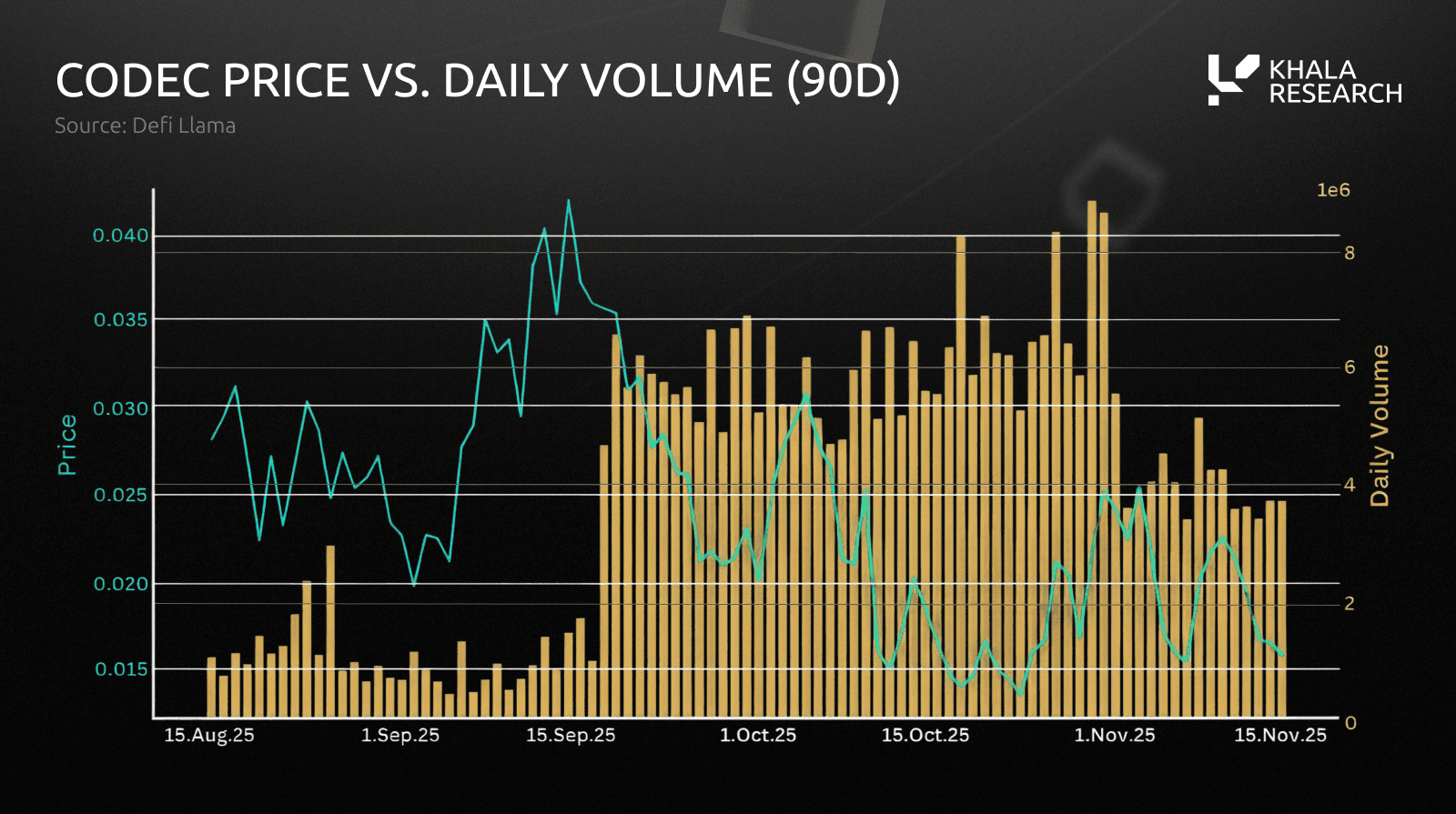

CODEC Token: Fair launched through Pump Fun on Solana.

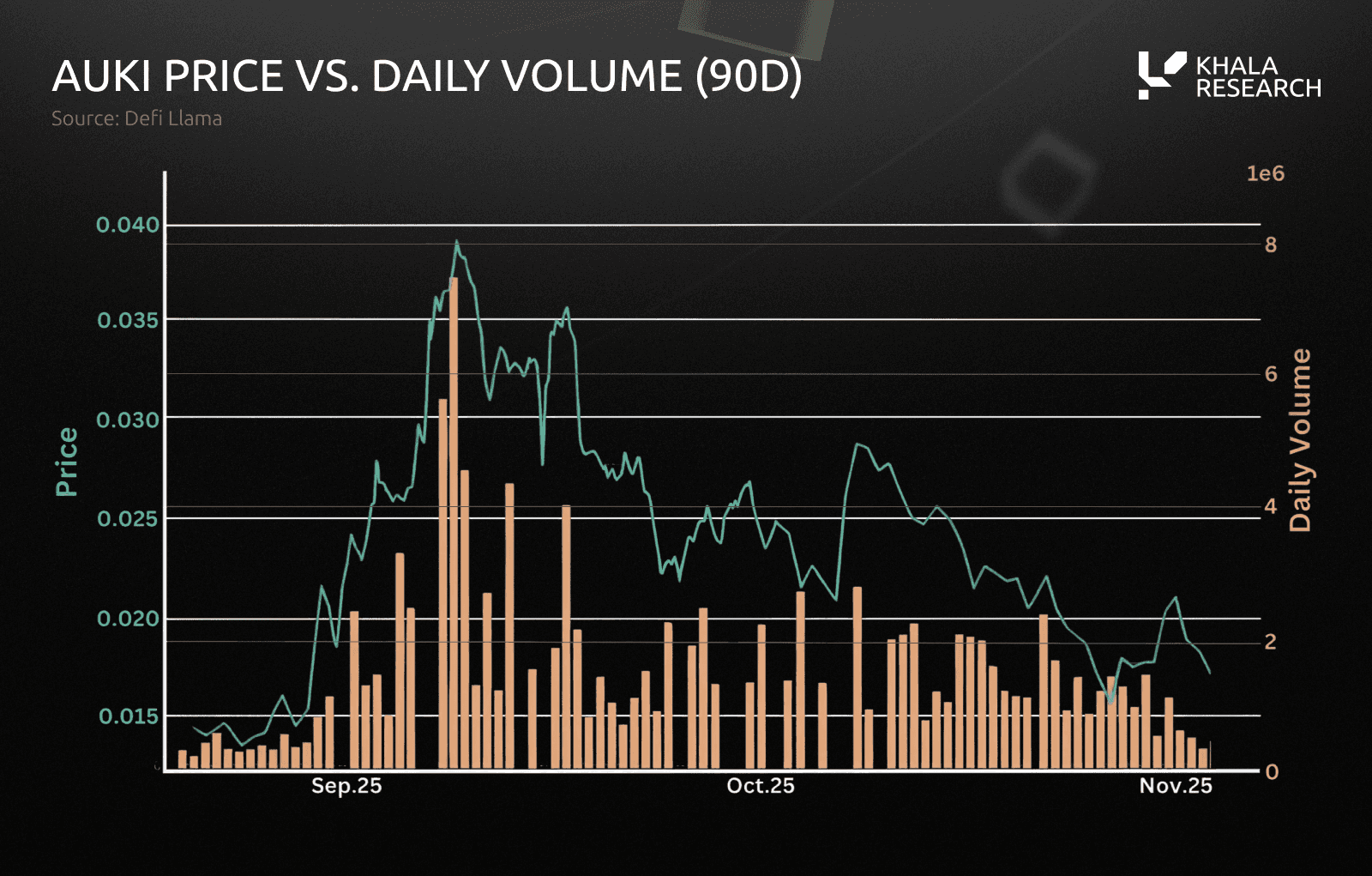

Its spike in volume on September 15th is attributable to its coverage, and traction, around VLA (Vision Language Action) models which provides Operators the ability to see, understand, and act in digital environments:

A comparative traditional AI entity would be Hugging Face, which builds open-source tools and platforms that make it easy for developers and companies to create, share, and deploy machine-learning models.

Revenue: Income can be generated from:

Marketplace Fees: Revenue from Operator publishing/licensing

Compute Rentals: $CODEC earnings for node operators contributing hardware

Premium Access: Token staking for reduced fees, priority deployment

Transaction Fees: Platform cuts from compute usage and task brokerage

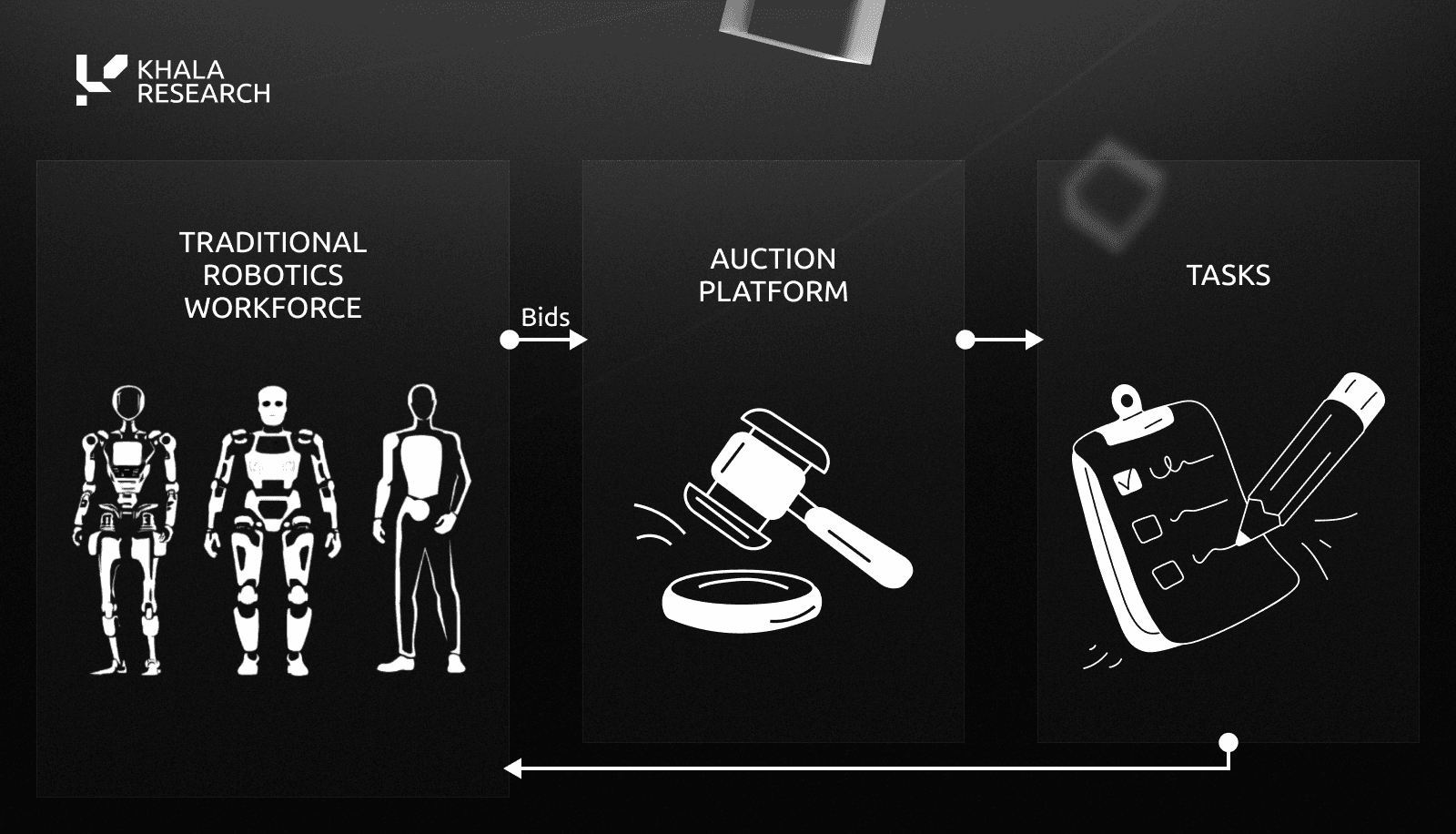

One of the largest opportunities to monetize DeRobotics projects is through an auction model between the traditional robotics workforce and tasks needing completion:

Projects that offer these brokerage services, or build the software that enables these two counterparties to transact, could earn reasonable fee revenue as activity ramps up.

CODEC offers a central hub for robotics companies to source tasks. It recently integrated Chainlink Runtime Environment (CRE) to build an autonomous delivery agent, MechaShip, with dynamic quotes.

It supports x402 micropayments by agents to access its central hub and is live on peaq’s MachineDEX (Decentralized Exchange on Mainnet).

If CODEC is able to onboard big name partners and align interests between the fundamentals of a lucrative auction system model and tokenholders, then this would bolster the protocol’s long term prospects for success.

“Software ate the digital world, embodied AI is about to eat the physical one. This future cannot be built in silos. CodecFlow is constructing the decentralized infrastructure from simulation to hardware that enables intelligent Operators to learn, act, and cooperate openly.” - Moyai, CodecFLOW CEO

3.5 - $AUKI

Decentralized Shared Spatial Computing

Auki uses its proprietary ‘Posemesh’ technology to create a shared 3D map of the world that robots and Augmented Reality (“AR”) devices can reference. This is dubbed the “Real World Web”.

Auki has rolled out devices using its XR tech “Cactus AI” within several Swedish supermarket stores for trials, and experimental mapping of surroundings, providing spatial awareness for embodied AI to operate. It already has active pilots with Toyota Material Handling, COOP Visby, and more with 2,300+ nodes in operation:

Current robotics partnerships include:

Shared spatial context enables multi-robot collaboration, object permanence, and navigation without centralized data servers. Here's Auki CEO Nils on our Supercycle Podcast, discussing the market opportunity of robotics:

Auki's core ‘Posemesh’ Technology:

This is Auki’s “moat” and provides the business with a tangible advantage in sustaining a lead in the decentralized spatial market segment.

Domains: Digital twins with three layers (semantic, topographic, rendering)

Collaborative SLAM: Multiple devices merge sensor data via overlapping portals

Edge Computing: Reconstruction nodes handle compute-intensive 3D processing

Privacy-First: Encrypted clusters with local computation, no global data sharing

Auki Token:

The $AUKI utility token on Base is burned by devices to access the Auki network on a metered basis. You burn a fixed amount of dollars worth of AUKI for credits. Recent price action has moved consistently with the broader DeRobotics narrative with an increase in attention in September:

Auki used a DEX-first launch strategy to build a strong organic community, and will launch on CEX in 2026.

Revenue + Operational Efficiencies:

Auki is one of a handful of protocols at the intersection of crypto and robotics that is demonstrating significant traction in the real world:

$2M+ annual recurring revenue from spatial solutions

30% reduction in time looking for products and walking distance from staff in trials

15 min/day/employee handover time reductions as part of COOP results

30 min/day productivity gains from spatial awareness

4,000 m²/store mapping completed in < 4 hours vs. days previously

Auki is positioning itself as the decentralised spatial layer for robots and AR, converting real-world environments into a shared, privacy-preserving compute fabric with proven enterprise traction.

3.6 - $NRN

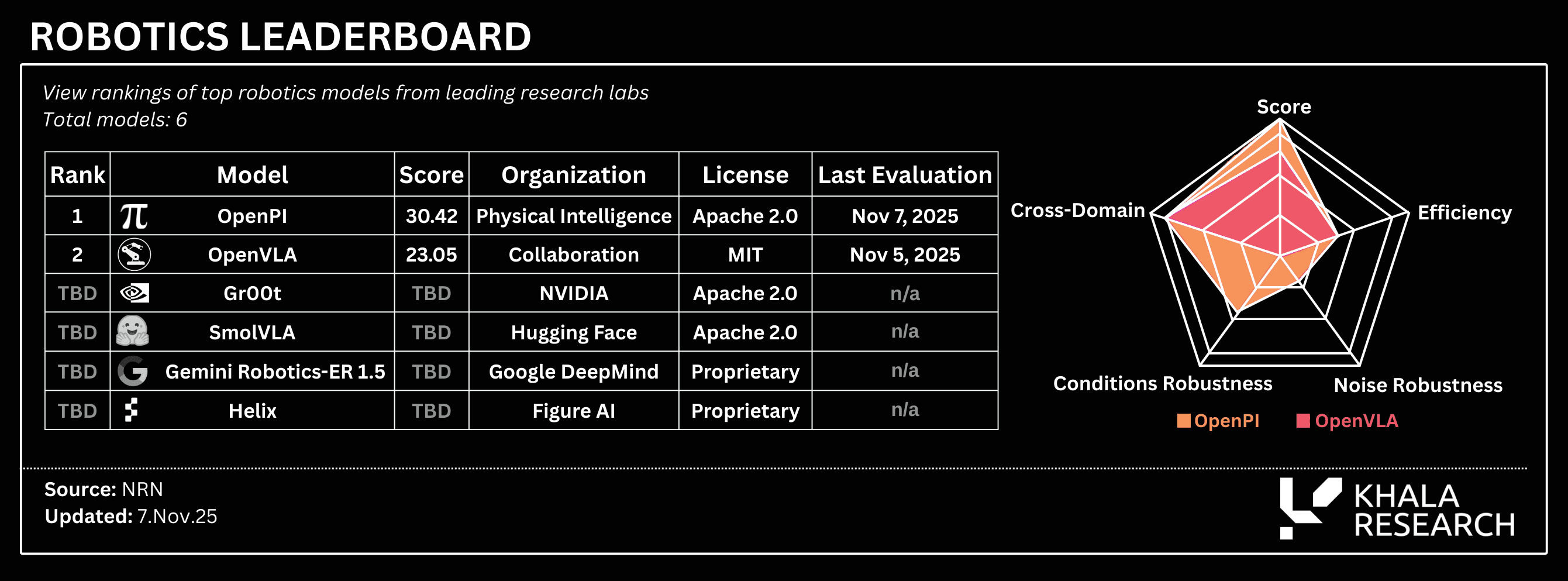

Neuron. Global Evaluation Layer for Embodied AI

Neuron (NRN) aims to:

“become the authoritative leader that serves as the global evaluation and reproducibility layer for embodied AI... the LMArena for multimodal (Vision-Language-Action), embodied agents”.

Dr. Nicholas Nadeau, former CTO of 1X, recently joined NRN as a Strategic Advisor. His deep experience in building production-grade, real-world robotic systems will prove invaluable.

SAI Platform: NRN launched ‘SAI’ (Chinese word for competition) which aims to become the evaluation standard for robotics across the key dimensions that define general intelligence. Beyond simple task completion, SAI assesses models on Competency (efficiency and score), Robustness (performance under diverse conditions and noise), and Generalization (adaptability across multiple tasks and embodiments).

Multi-Pronged Benchmarking Platform:

Independent Standard: Proprietary assessment framework for objective and rigorous evaluation of leading VLAs

Social Validation: Human-preference scoring of pair-wise VLAs' outputs (actions) to provide crowdsourced feedback loops on policy behavior in diverse, human driven scenarios

Eval for Teleoperation: Extends the pairwise comparison engine to human-teleoperated workflows.This layer generates subjective quality data to benchmark hardware efficacy and operator performance.

Strategy & Incentives: $NRN used a co-ordination and incentive mechanism to aggregate human preference data to improve frontier robotic model performance. Token can also be used to subsidize compute resources necessary to power ongoing research and innovation on the SAI competition platform.

It’ll take time for the public to trust robots, so having human input to how they move and interact in the real world will be imperative for a seamless integration into society. Just because a robot does a task more efficiently than a human, doesn’t mean that it’s the optimal method deployed; that’s where “social validation” comes into play.

Monetization: Establishing a leadership position in robotics eval creates a gravitational pull of attention towards the SAI and NRN brands within the industry and serves as the foundation to roll out high-margin commercial opportunities like: Third-party Auditing & Trust Services, Enterprise Evaluation SaaS.

In an agentic economy, model evaluation and benchmarking will emerge as the new business diagnostic tooling infrastructure. LMArena is proving the financial thesis, raising a $100 million seed round at a staggering $600 million valuation by monetizing trust and advanced enterprise analytics for LLMs.

Ecosystem: Rumoured to be integrating SAI eval platform alongside major robotic simulation ecosystems such as Isaac Sim (NVIDIA) and MuJoCo (Google).

“Robotics is currently stuck in the "demo-ware" and lacks the vital evaluation infrastructure that propelled the LLM revolution. The most valuable unclaimed category is this missing benchmarking standard. We are building the independent evaluation layer the industry desperately needs.” - Wei Xie, Co-Founder and COO, ArenaX Labs

3.7 - $DEUS

XMAQUINA. Humanoid Robotics Investment DAO

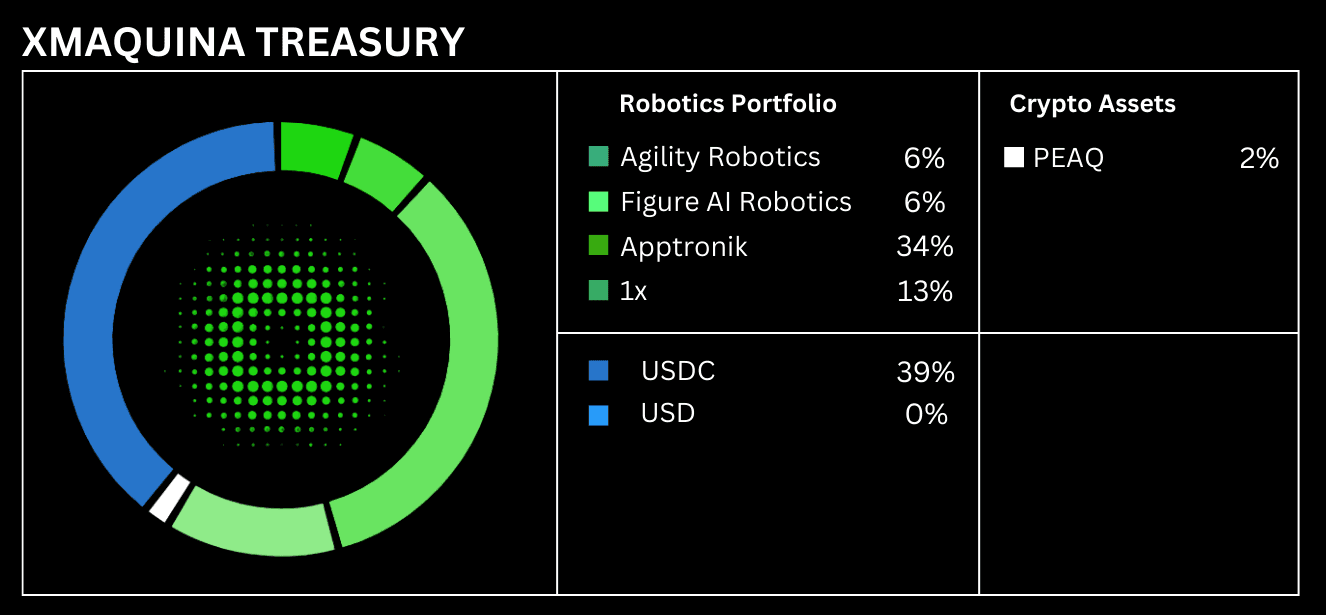

XMAQUINA, ticker $DEUS, enables anyone to invest in early stage robotics companies. What was only previously possible to large ticket investors like a16z, by holding $DEUS, you can participate in private venture rounds of robotics companies like 1x, Agility etc.

$DEUS currently has a treasury Net Asset Value (NAV) of ~$36M, including Equity stakes in Figure, Apptronik, Agility Robotics, NEURA Robotics and 1X Tech:

Think of this similar to the thesis for gaming DAOs in 2021 - a holder of gaming tokens like YGG and BEAM back in 2021 offered investors index exposure to web3 gaming, XMAQUINA is taking a similar concept to enable retail to participate in early stage robotic investments.

Capital was raised through tranches of sales of its DEUS token, which is scheduled to launch within the next eight weeks, with the following details:

TGE Trigger: Requires DAO governance vote (not automatic timeline)

Vesting Structure: 33% unlock at TGE, 67% linear over 12 months

Cross-chain: Deployed on Base and peaq via LayerZero

Value Accrual Mechanisms:

No Management Fees: Zero traditional 2% VC-style annual fees

Team Compensation: Via vested token allocation (12.5%) + Foundation (7.5%)

Revenue Flow: All profits to DAO treasury for DEUS holder benefits

Sustainability: 5% allocation from sub-DAO tokens + machine revenue

Buyback Mechanisms: Treasury returns fund DEUS buybacks/rewards

Dividend Alternative: Revenue sharing vs. traditional equity distributions

Self-Funding: Post-TGE operations funded by returns, not fees

The value in this protocol is in the types of private investments that XMAQUINA is able to make by leveraging its network opportunity access, which is clearly strong based on its existing treasury.

The veDEUS token model enables holders to govern the activity of the DAO. For example, distributing the benefits (capital appreciation or dividends) of these underlying robotics businesses (through buybacks or otherwise).

The DEUS token should track the performance of the underlying robotics businesses it invests in, but there will likely be a deviation from its treasury Net Asset Value (NAV) for several reasons; including market access, liquidity, and/or conversely; impairment indicators.

But the ability to actively trade or gain exposure to otherwise private robotics markets demonstrates the real value of bringing capital markets onchain, particularly the less efficient private markets that typically only permit access to accredited investors.

As regulatory clarity is provided around ownership rights for tokenholders then we could see an “ICO” season as businesses come onchain and investment vehicles, like XMAQUINA, become more globally accepted.

“Access to private equity in deep tech, especially in the AI and humanoid segment, has traditionally been restricted to a small group of institutional investors. XMAQUINA is designed to change that. Through a governed, onchain structure, we’ve built exposure to leading companies in the field, including Figure, 1X Technologies, Agility Robotics, and Apptronik, with a growing pipeline that includes NEURA Robotics and others.

These positions offer $DEUS holders real exposure to a sector that is not only transforming labor, but also reshaping logistics, mobility, manufacturing, and human-machine systems.” - Mauricio Zolliker, Founding Member of XMAQUINA

As of Jan 8 2025, XMAQUINA raised an additional $3.25 million USD in an auction hosted with the Virtuals protocol. This brings the total to $10 million USD raised for the DAO to participate in investments.

3.8 - $TAO Subnets

Bittensor. Decentralized Fabric for AI + Robotics

Bittensor (“TAO”) is an ecosystem of subnets that are tailored specifically to a variety of real world use cases, a number of which have been identified as world class AI models.

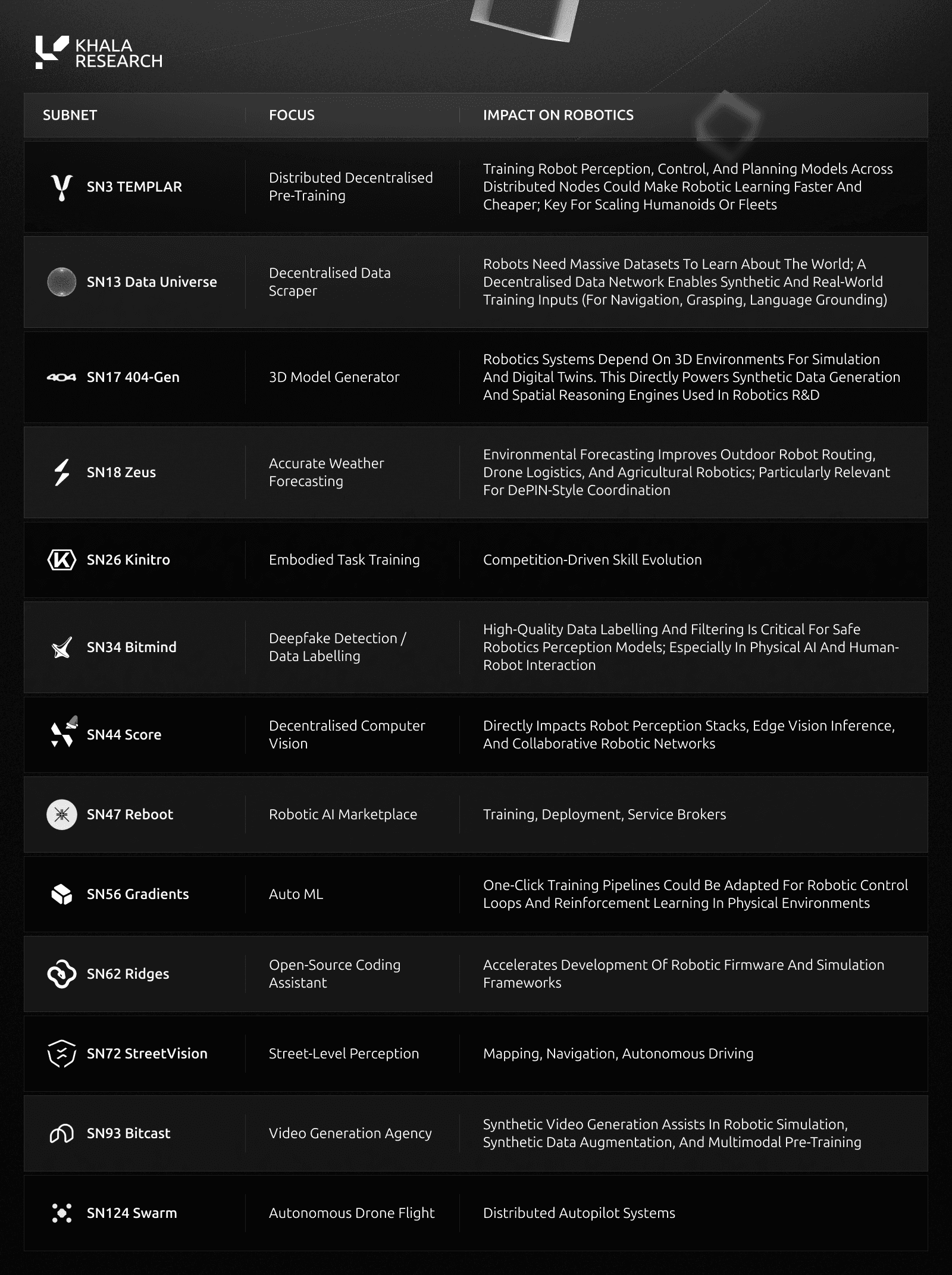

Several subnets are relevant to robotics:

Robotics requires massive multi-modal data and continuous fine-tuning. Centralized AI systems struggle to scale across variations in hardware, environment, and policy.

Bittensor provides a market for intelligence, letting robots pay for the skills they need (including edge cases), particularly as payment protocols (like x402) provide the infra for trillions of agentic micropayments.

3.9 - OpenMind [Pre-TGE]

Openmind AI: The “Android for Robots”

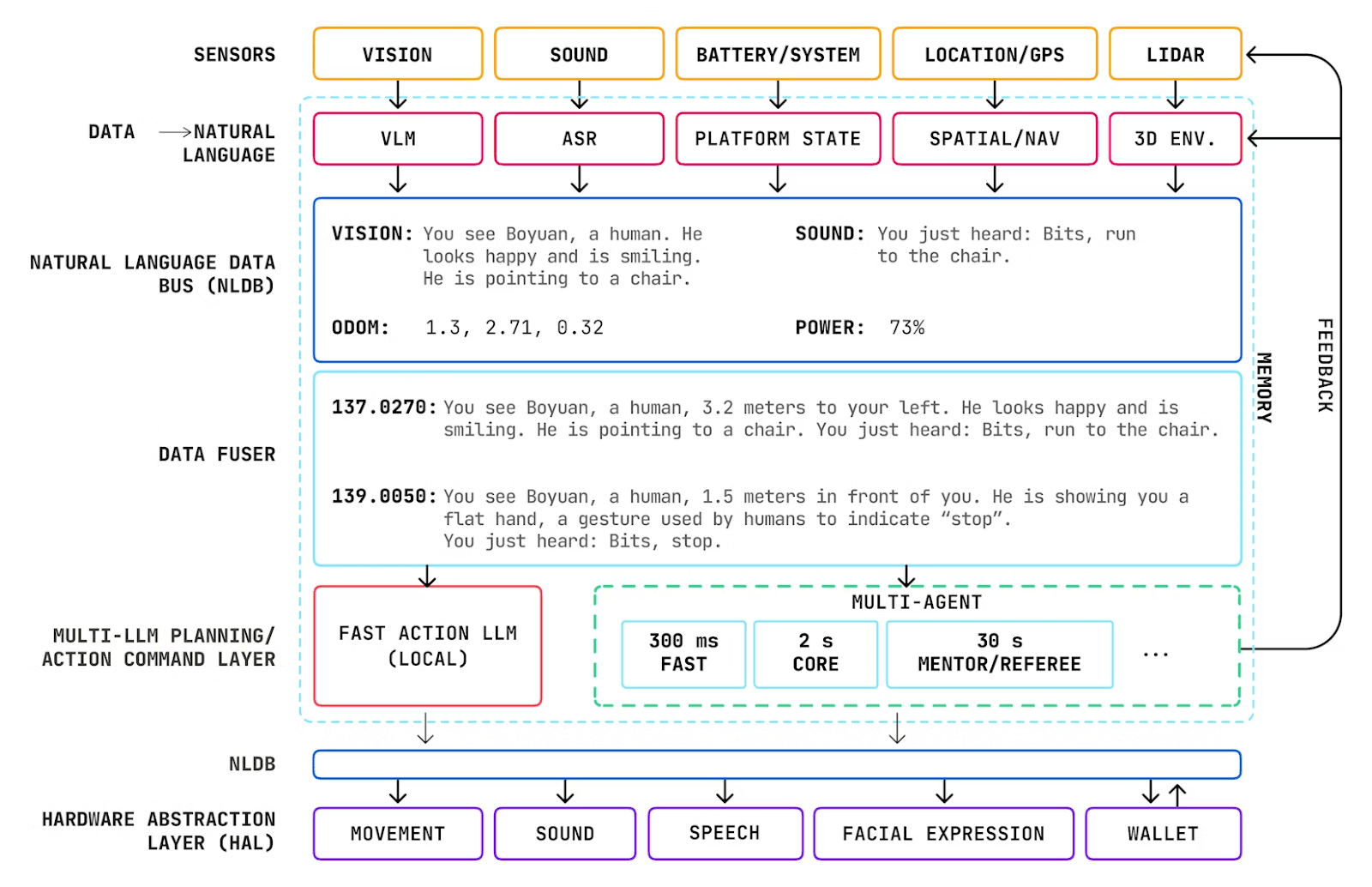

OpenMind provides the foundational software layer for autonomous robotics through OM1, an open-source AI-native operating system handling perception, memory, planning, and action.

Similar to how Android unified mobile devices, but purpose-built for intelligent machines.

Complementing OM1 is “FABRIC”, a decentralized coordination network that enables robot identity verification, proof-of-location, task coordination, and autonomous stablecoin settlements for machine-to-machine collaboration across diverse hardware platforms.

Economics:

With $20M funding raised in August 2025 led by Pantera Capital (Coinbase Ventures, DCG, Ribbit Capital participating), OpenMind remains pre-TGE with no token launched as of December 2025.

The project focuses on building organic developer adoption through its Developer League program ($250K in credits for OM1 contributors), which has attracted over 100 contributors and 10,000+ users building on the platform.

Partnerships:

The recent Circle partnership (December 2, 2025) introduces the x402 payment protocol using USDC for autonomous M2M transactions, while the NEAR Protocol integration (December 3, 2025) brings hardware-backed privacy AI services through verifiable Trusted Execution Environments (“TEEs”).

Millions of robots will be produced from a variety of manufacturers in the coming years; having a foundational software layer like OM1, will be imperative for seamless operational performance across the varying stacks.

"AIs, when given full control of highly mobile physical shells, can explore the world, learn, interact, chase squirrels, and help blind people. Let’s make this new world open and durably aligned with humans. This means (1) open software and (2) modular brain architectures that allow humans to inspect, understand, trust, and debug thinking machines." - Jan Liphardt, Founder Openmind

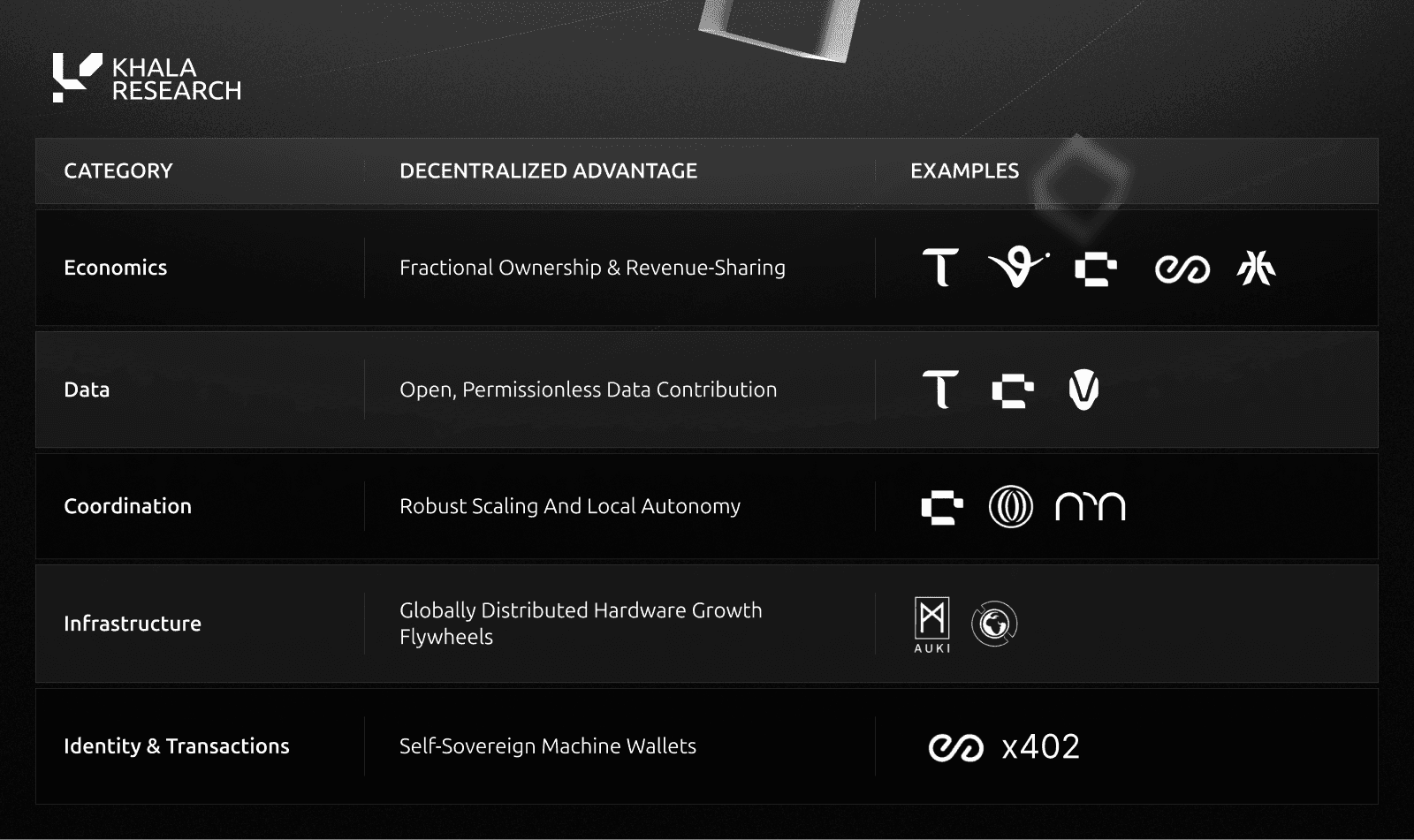

4. Strategic Advantages of Decentralized Robotics Networks

The composability between these networks is a core strategic edge.

Example:

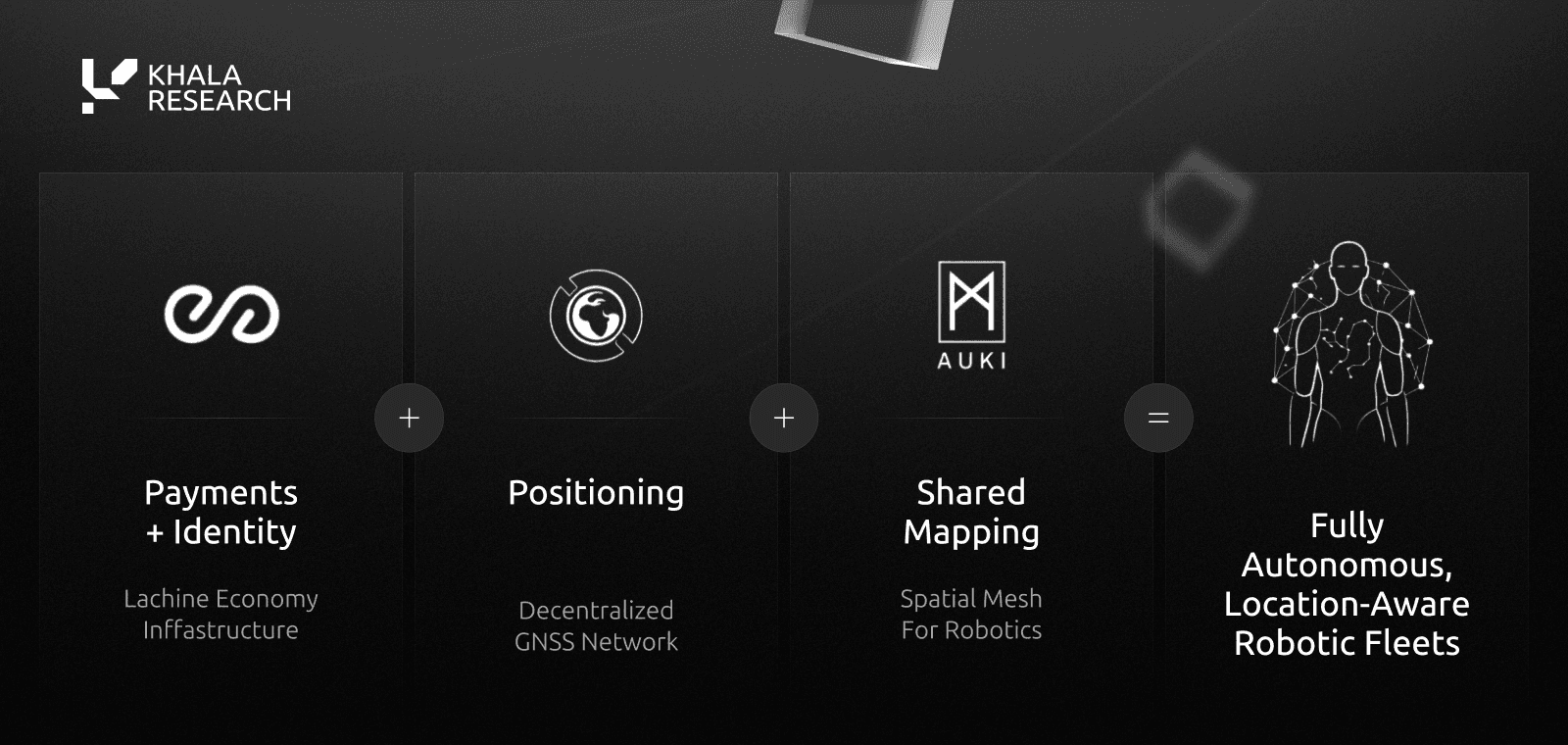

Peaq (payments + identity) + GEODNET (positioning) + Auki (shared mapping) = autonomous, location-aware robotic fleets

Openmind and Codec are prime examples that offer robotics agnostic software developer kits (SDK) that can then be plugged into any traditional robotics hardware, rather than having to have the “Apptronik SDK” or “Figure SDK”, specifically.

5. Risks and Constraints

Sector remains high variance, but risk is distributed across multiple protocol layers.

Risk Type | Impact | Mitigation Signals to Watch |

|---|---|---|

Technical | Robotics hardware progress may lag expectations | Monitor humanoid manufacturing cost curves |

AI Performance | Embodied intelligence may require larger datasets than expected | Scaling of Bittensor robotic subnets |

Regulatory | Autonomous systems may face jurisdictional restrictions | peaq’s regulatory MoUs (e.g., Dubai VARA) |

Token Design | Economic leakage if contribution incentives weaken | Sustained burn, fee and revenue share mechanisms |

Much of the DeRobotics will be focused on the software, while traditional robotics entities build out the hardware capabilities. The main reason for this is funding; it costs magnitudes more to develop physical infrastructure, particularly at scale to enable an affordable entry.

6. Investment Outlook

6.1 - Valuation Asymmetry

Traditional robotics equities are valued in the tens to hundreds of billions, while DeRobotics tokens trade at sub-$1B valuations despite similar market exposure.

The projects covered in this report constitute <$200m (27%) of the overall market capitalization of DeRobotics segment:

The driver for the comparably low market cap (compared to traditional robotics) is that most of the large robotics companies deal with hardware, which inevitably has a significant amount more initial capital outlay and fundamental value than software, given the tangible materials consumed. Particularly as raw material prices continue to soar.

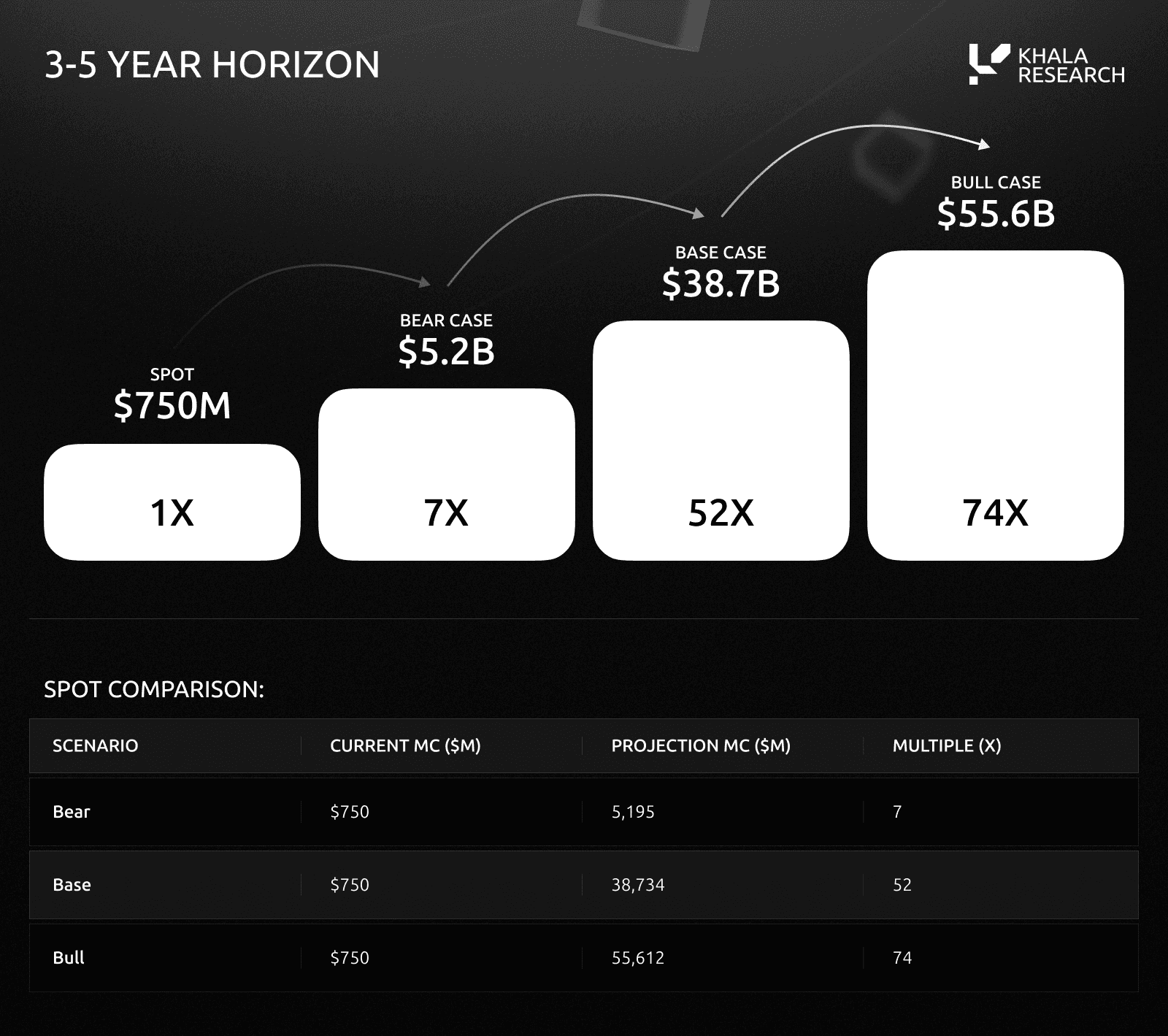

6.2 - Scenario Modeling

3-5 Year Horizon

Assumptions:

AI Capability growth: Model inference costs fall 30–50% annually due to hardware and software efficiency and general models increasingly generalize to physical tasks with minimal fine-tuning

Robotics Hardware Curve: Cost per degree-of-freedom for humanoids declines 20–30% per year (consistent with Electric Vehicle motor + actuator cost deflation)

Consumer Adoption: Household robots follow a similar curve to smart speakers:

1–3% early adopters by 2026

10–15% penetration by 2030

Commercial Adoption: Warehouse, retail, and agriculture robotics continue 20–30% CAGR seen in industrial automation

Government Adoption: National policies continue favouring domestic robotics and semiconductor production, helping subsidize deployments

Dataset Growth: Robotics datasets grow 10x between 2025–2030

Robotics Market Growth: Move consistently with traditional robotics % CAGR

Token Economics: Network fees scale with activity (Token buybacks tied to real revenue create direct value accrual)